The recent inflation data seems to ward off the investor nightmare. The troubles of aggressive interest rate hikes by the Federal Reserve and the possibility of a hard landing for the economy no longer appear to breathe down their neck. However, these projections appear to be a financial candyfloss, masking the recent upheaval of gas prices and retail earnings, which indicate another challenging month for the fight against inflation.

While most consumers focus on the fluctuation of interest rates by the U.S. Central Bank, their most stimulative economic tool, the balance sheet remains an enigma. This behind-the-scenes element of Fed policy has immense implications for the U.S. economy, the stock market, monetary policy, and your pocketbook.

What is the Fed Balance Sheet? How is it used?

Like any other balance sheet, the Federal Reserve exhibits its assets and liabilities. The assets chiefly consist of U.S. Treasury notes, bonds, and agency mortgage-backed securities. Its liabilities are primarily the U.S. currency in circulation, bank reserves held in Fed accounts, and reverse repurchase agreements collateralized by Treasury securities. When the Federal Reserve buys debt instruments such as Treasury notes or mortgage-backed securities, it strives to supplement their price and lower yields while prompting a laxer monetary policy to support the economy, known as the up-cycle. Conversely, the sale of Fed assets is a policy-tightening approach that curbs the asset values and dampens the financial set-up, known as the down-cycle.

Correlation between Market and Fed Balance Sheet

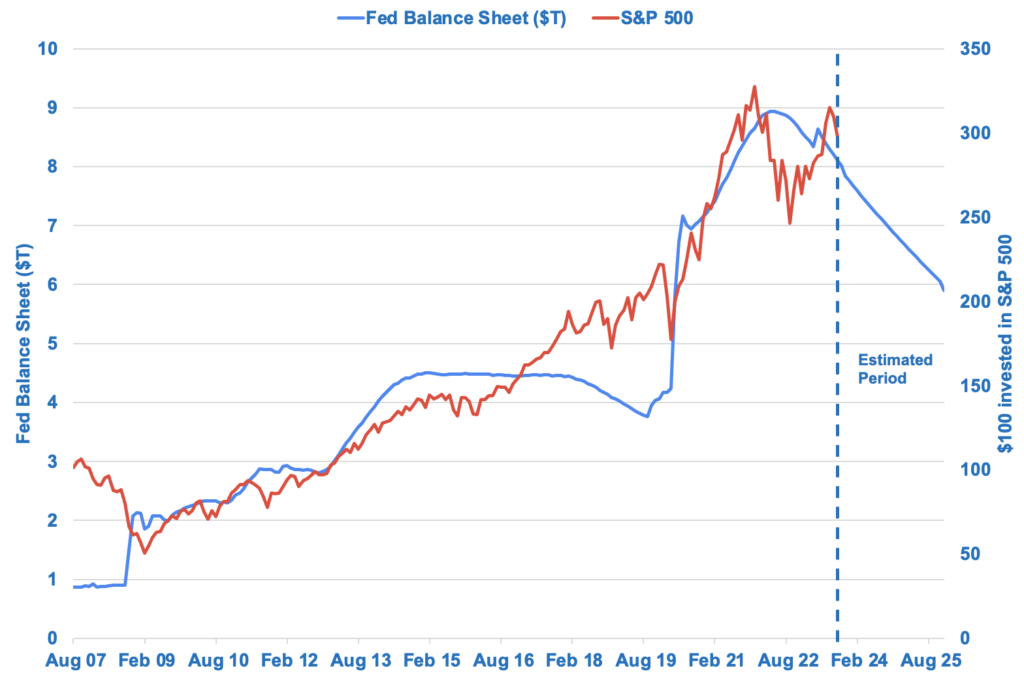

Past data suggests that markets tend to outperform when the Federal Reserve expands (up-cycle) its balance sheet. The excess liquidity generated during up-cycles by the Fed transactions ensues buying pressure in riskier asset classes, including equities. As we can see below, the S&P500 has generated above-average annual returns in up-cycles and below-average annual returns in down and steady cycles until June 2022. But more recently, we have experienced a trend reversal from July 2022 until today since the balance sheet has shrunken from $8.9T to $8.1T, and the S&P 500 and generated above-average returns of 15.15%.

There are many strong points in the economy that support the upward movement:

1. Robust GDP Growth: The U.S. economy continues to showcase strong performance with a notable GDP growth rate of 2.4% in Q2 vs 1.6% in Q1. This sustained economic expansion signifies resilience and potential opportunities for businesses and investors.

2. Easing Inflation: Inflation, a critical factor impacting investment decisions, has shown signs of easing with a year-on-year rate of 3.7% in August 2023 vs 8% a year before. A controlled inflation rate instills confidence in the stability of prices, enabling businesses to plan and consumers to make informed purchasing decisions.

3. Strong Labor Market: The labor market’s strength is evident, as indicated by the 60.4% employment rate as of August 2023. A strong labor market typically leads to higher wages, reduced unemployment, and increased consumer spending, fostering a positive economic environment.

4. Resilient Consumer Spending: The U.S. economy benefits from consumer spending increasing by 2% YoY, as of August 2023. This is despite living in a high-interest rate environment, showcasing a consumer base willing and able to contribute to economic growth. A robust consumer spending trend reflects consumer optimism and financial well-being, contributing significantly to overall economic health.

Where are we now?

The Federal Reserve has almost $8.1 trillion in assets on its balance sheet. Historically, the steady rate of increase in the balance sheet for the Fed has been 15% annually. However, due to COVID-related disruptions, the Fed expanded its assets by more than 39% annually from early 2020 until mid-2022. Now, the Fed has been focusing on shrinking the balance sheet.

What does the future hold?

A May 2022 projection by the Federal Reserve Bank of New York shows the balance sheet declining to $5.9 trillion in 2025. That would imply an annual reduction in the balance sheet by almost 13%. The Fed has never engaged in such unprecedented levels of withdrawals of liquidity.

How will the Fed reduce the size of its balance sheet?

Fed has two ways to do it: Selling Securities or Ceasing to Reinvest in Maturing Securities. In January 2022, the Fed said that it plans to “significantly” reduce its balance sheet “over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held” as opposed to selling bonds from its portfolio, but did not provide any more specifics as to the size, pace, or composition of these reductions. However, the Fed did say that in the “longer run,” it plans to hold primarily Treasury securities rather than mortgage-backed securities because it seeks to minimize its role in allocating credit to different sectors of the economy.

This graph could sketch years of latent underperformance of the stock markets. Empirical evidence from historical data also suggests significant risks to equity markets. Particularly for longer-duration assets, including growth stocks, whose valuations were driven to notably high levels by the Fed’s easy monetary policy. We could be in for a significant market correction if the Fed surprises markets by rapidly reducing its balance sheet. However, considering the strong economic signals observed recently and the strong inertia these signals carry with them, the markets will experience a rather “soft landing”, if not remain steady. Ultimately, we are still at that phase of the economic cycle where there are more impediments than opportunities. Thus it becomes imperative to pick stocks supported by the current dynamics. Investors should consider strategic asset allocation and diversification concentrated on some sectors.