“Diversification is the only free lunch in investing.” – Dr. Harry Markowitz, Nobel Prize-winning economist

What is Diversification?

As Dr. Markowitz stated, diversification is a crucial strategy for managing risk in your investment portfolio. By spreading your money across various asset classes, sectors, and geographies, you can minimize the impact of any single investment’s performance on your overall returns. This strategy proves particularly valuable during market volatility.

Let’s consider a scenario to illustrate this point. On July 8, you have a $100,000 portfolio fully invested in Nvidia stock. By August 8, Nvidia’s stock price dropped by approximately 20%. This reduces your portfolio value to $80,000, resulting in a significant $20,000 loss.

Now, let’s look at an alternative, diversified approach. Instead of putting all your money in Nvidia, you invest $50,000 in Nvidia, $30,000 in a broad market index fund tracking the Russell 2000, and $20,000 in bonds. In this case, your outcome would be different.

Your Nvidia position would lose $10,000. However, your Russell 2000 index fund would gain about 2% ($600). Your bonds might remain stable. As a result, your total portfolio value would now be approximately $90,600. This limits your loss to $9,400 instead of $20,000.

S&P500 and VIX Daily Returns Exhibit Inverse Relationship Throughout 2024

For investors looking to diversify their portfolios, three of the most popular vehicles are exchange-traded funds (ETFs), mutual funds, and index funds. All three allow you to invest in a basket of securities, but they have some key differences.

What are ETFs, Mutual Funds, and Index Funds?

Before we dive into comparing these investment vehicles, let’s make sure we understand what each one is and how they work.

Exchange-Traded Funds (ETFs)

ETFs are investment funds that trade on stock exchanges, just like individual stocks. They typically track a specific index, sector, commodity, or other asset class. When you buy shares of an ETF, you’re essentially buying a slice of a pre-assembled portfolio.

Some key characteristics of ETFs include:

- Continuous pricing: ETFs can be bought and sold throughout the trading day at market prices.

- Transparency: Most ETFs disclose their holdings daily, so you always know what you own.

- Tax efficiency: Due to their unique structure, most ETFs are able to minimize capital gain distributions and defer tax bills until they sell shares. This can help preserve capital for reinvestment and potentially higher returns.

Mutual Funds (MFs)

Mutual funds are investment vehicles where many investors pool their money together to purchase a portfolio of securities. The fund is managed by a professional fund manager who makes decisions about what to buy and sell within the fund.

Some key characteristics of mutual funds include:

- Active or passive management: Mutual funds can be either actively managed (where the manager tries to beat a benchmark) or passively managed (where the fund simply tracks an index).

- End-of-day pricing: Mutual fund shares are priced once per day after the market closes, based on the fund’s net asset value (NAV).

- Minimum investments: Some mutual funds have minimum initial investment amounts.

Index Funds

Index funds are a type of mutual fund or ETF designed to track the performance of a specific market index, like the S&P 500. The goal of an index fund is to deliver returns that closely mirror the benchmark index, minus a small fee.

Some key characteristics of index funds include:

- Passive management: Index funds are passively managed, meaning the fund manager doesn’t make active decisions about what to buy and sell. Instead, they aim to match the holdings and performance of the target index.

- Low costs: Because index funds don’t require active management or extensive research, they tend to have much lower expense ratios than actively managed funds.

- Broad diversification: Index funds provide exposure to a wide range of securities within a single investment. For example, an S&P 500 index fund would give you a stake in 500 of the largest U.S. companies.

It’s important to note that the lines between these categories can blur. For instance, you can have an index fund that is structured as either a mutual fund or an ETF. And while most ETFs are passively managed, there are some actively managed ETFs. Therefore, it is crucial to conduct due diligence on them before investing, to ensure they align with your specific investing goals and preferences. Looking at the factsheets of these vehicles is a great starting point.

Major Differences Between ETFs, Mutual Funds, & Index Funds

Cost Comparison

One of the most significant differences between these fund types is their cost structure. Passively managed index funds, whether structured as ETFs or mutual funds, tend to have the lowest expense ratios.

For example, the average expense ratio for index funds is around 0.13%, according to Morningstar. Actively managed mutual funds, on the other hand, have an average expense ratio of 0.66%. ETFs fall somewhere in between, with an average expense ratio of 0.44%. However, this figure can vary widely depending on the specific fund and its investment strategy.

It’s important to note that not all ETFs are cheap, and not all mutual funds are expensive. Actively managed ETFs often have higher expense ratios that are more in line with mutual funds. And some index mutual funds, like those from Vanguard, rival ETFs in terms of low costs. The key is to always check the specific expense ratio of any fund you’re considering.

Liquidity

Another key difference is how these funds are bought and sold. ETFs trade on stock exchanges throughout the day, just like individual stocks. This means investors can buy/sell shares at any time during market hours at the current market price, offering greater flexibility and liquidity. This can be especially advantageous during periods of market volatility, as investors have more control over trade timing.

However, mutual funds, including index funds structured as them, are priced once per day after the market closes. This pricing is based on their net asset value (NAV). Meaning, when you buy/sell a mutual fund, you won’t know the exact price until after the market closes. Additionally, some mutual funds have penalties for short-term selling, which can further reduce flexibility and liquidity.

However, this lower flexibility can also be a positive feature, as it protects long-term investors from intraday price swings.

Ease of Access

ETFs and mutual funds differ in their accessibility for investors. Generally, ETFs have lower minimum investment requirements compared to mutual funds, making them more accessible to a broader range of investors. Some mutual funds may require a minimum initial investment of several thousand dollars, which can be a barrier for smaller investors.

Moreover, ETFs can typically be bought and sold through most brokerage accounts, providing investors with more flexibility in managing their portfolios. On the other hand, some mutual funds may only be available through specific platforms or financial institutions. This can limit investors’ choices and potentially increase the complexity of managing their investments across multiple accounts.

Tax Efficiency Advantages

In general, ETFs tend to be more tax-efficient than mutual funds due to their unique structure. When you invest in a mutual fund, the fund manager buys and sells securities within the fund. If these trades result in a profit, the mutual fund must distribute those capital gains to its shareholders. These distributions are taxable events, meaning you’ll owe taxes on those gains even if you don’t sell your mutual fund shares.

ETFs, on the other hand, are structured differently. When an investor wants to redeem their ETF shares, they can be exchanged directly with Authorized Participants (typically large institutional investors) for the underlying securities. This “in-kind” redemption process minimizes the need for the ETF to sell securities and generate capital gains.

It’s important to note that ETFs aren’t completely tax-free. If you sell your ETF shares for a profit, you’ll still owe capital gains taxes. And if an ETF has to sell securities to reflect changes in its underlying index, that can also generate capital gains. However, historically, ETFs have been more tax-efficient than comparable mutual funds.

Index funds, whether structured as ETFs or mutual funds, tend to be more tax-efficient than actively managed mutual funds. This is because index funds typically have lower turnover (buying and selling of securities) than actively managed funds, resulting in fewer taxable events.

If you’re in a higher tax bracket, the tax efficiency of ETFs and index funds can be particularly advantageous, as it can help minimize your tax bill and keep more of your investment returns working for you.

Performance Comparison

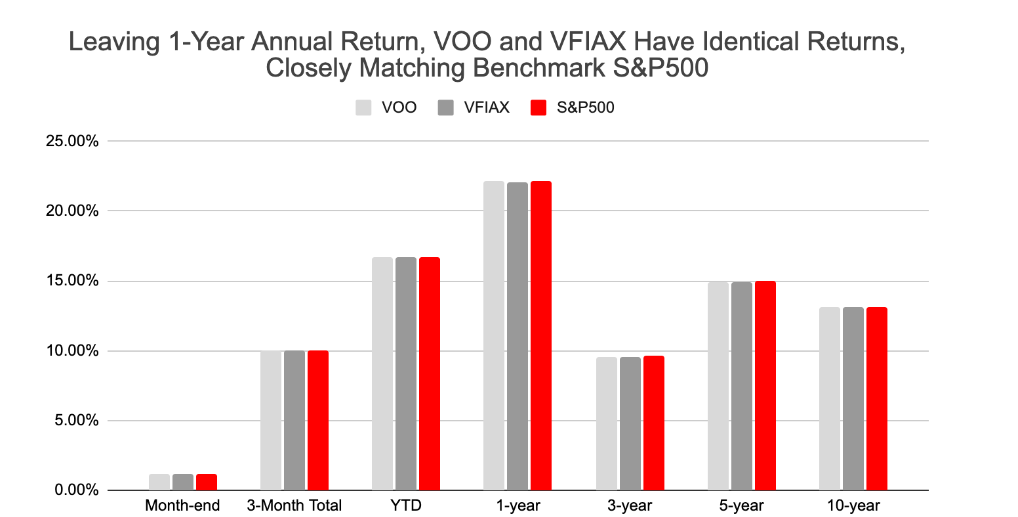

When it comes to performance, passively managed index funds (whether ETFs or mutual funds) generally deliver returns that closely match their target benchmark, minus fees. For example, both the Vanguard S&P 500 ETF (VOO) and the Vanguard 500 Index Fund Admiral Shares (VFIAX) have posted nearly identical 10-year returns of just over 13% annually, according to Morningstar data.

| Month-end | 3-Month Total | YTD | 1-year | 3-year | 5-year | 10-year | |

| VOO | 1.21% | 10.04% | 16.67% | 22.12% | 9.55% | 14.95% | 13.11% |

| VFIAX | 1.21% | 10.04% | 16.67% | 22.10% | 9.55% | 14.95% | 13.11% |

| S&P500 | 1.22% | 10.05% | 16.70% | 22.15% | 9.60% | 15.00% | 13.15% |

Actively managed mutual funds, on the other hand, have the potential to outperform their benchmarks by leveraging the expertise of skilled fund managers. Proponents argue that active management can be particularly advantageous in less efficient markets, such as small-cap stocks or emerging markets, where there may be more opportunities to identify mispriced securities.

However, historical data suggests that most actively managed funds struggle to consistently beat their benchmarks after accounting for fees. According to S&P Dow Jones Indices, over the 15-year period ending December 31, 2023, 88% of large-cap actively managed funds underperformed the S&P 500. Similarly, nearly 90% of mid-cap and small-cap actively managed funds underperformed their respective S&P benchmarks.

While some actively managed funds may outperform in the short term, maintaining that outperformance over the long term has proven challenging. A Morningstar study found that none of the top-quartile active domestic equity funds as of December 2019 maintained their top-quartile performance over the subsequent four years.

Investors should carefully consider the track record and consistency of an actively managed fund before investing, as higher fees can eat into returns. For those seeking more reliable, cost-effective performance, passively managed index funds may be a better choice.

Building a Diversified Portfolio

So which one is the best tool for diversifying – ETFs, mutual funds, or index funds? The reality is all three can play a role, and the lines between them often blur. Many experts recommend using low-cost, broad market index funds (either ETFs or mutual funds) as the core building blocks of a diversified portfolio. For example, you might put 60% in a U.S. total stock market index fund, 30% in an international stock index fund, and 10% in a U.S. bond index fund.

Then, you can add “satellite” positions in actively managed funds where you see greater potential for outperformance, like in small caps or emerging markets. The key is to keep these active bets a small portion of your overall portfolio and be very selective about fees.

For a new investor, just starting to diversify, a simple three-fund portfolio of index funds could be a great starting point. As your portfolio grows, you can add more granular index funds and introduce some active funds around the edges.

Ultimately, the right mix of index funds, ETFs, and active mutual funds will depend on your specific situation and preferences. And that’s where Alphanso’s personalized recommendation engine can be a game-changer. By leveraging advanced AI and machine learning, Alphanso can analyze your inputs and generate a customized portfolio plan optimized for your unique goals.

Created by: Pankhti Antani, Financial Analyst

Twitter Linkedin Medium