May was a positive month for both equity and fixed-income markets. The S&P 500 index rose by 4.8%, while 10-year Treasury yields fell by 18 basis points, ending at 4.51%. This dual movement in equities and bonds highlighted a notable shift in investor sentiment.

The economic data released during May was softer than anticipated. This unexpected softness raised expectations for sooner-than-expected interest rate cuts, sparking a rally in the markets. Investors, anticipating a more accommodative monetary policy, responded positively.

Tech Giants Propel S&P 500 Gains

A significant portion of the S&P 500’s gains in May can be credited to four mega tech stocks. Nvidia $NVDA surged by an impressive 26%, Apple $AAPL saw a 13% increase, Microsoft $MSFT climbed by 6.8%, and Alphabet $GOOG rose by 6%. These substantial gains were slightly offset by a 0.60% decline in energy stocks, showing a mixed performance across sectors.

Labor Market and Inflation Dynamics

The labor market presented a mixed picture. April’s unemployment rate inched up from 3.8% to 3.9%, signaling slight weakening. Additionally, GDP growth decelerated to 1.3%, and the headline Consumer Price Index (CPI) for April came in lower than expected at 0.3% month-over-month.

Despite these figures, disinflationary trends appear to be stalling. Price pressures in the services sector remain persistent, which is concerning. The minutes from the May Federal Open Market Committee (FOMC) meeting echoed these concerns, highlighting the lack of progress on disinflation and reducing hopes for an imminent rate cut.

Navigating a Challenging Investment Landscape

Given the current market valuations, finding attractive investment opportunities has become increasingly challenging. In this environment, robust risk management and portfolio diversification are more critical than ever. Emphasizing high-quality companies with stable financial fundamentals, reasonable valuations, and consistent earnings growth is essential for maintaining a resilient portfolio.

Alphanso Performance Update

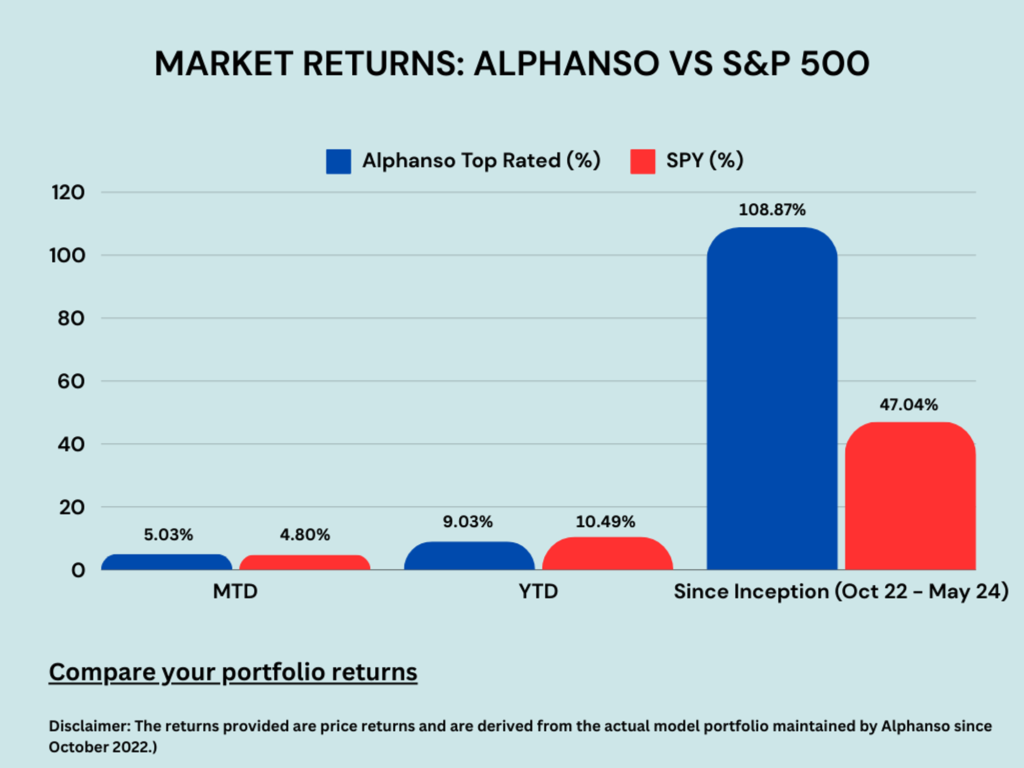

In May, our top-rated stock portfolio outperformed the S&P 500, gaining 5.03%. This slight edge underscores the effectiveness of our investment strategy and the careful selection of stocks in our portfolio.

As we move forward, staying vigilant and adaptable will be key to navigating the evolving market landscape. Robust risk management, careful stock selection, and a focus on diversification remain our guiding principles.