Relying on Assets Under Management (AUM) as the primary fee structure is often viewed as a simplistic approach to fee-setting. Asset-based fees fluctuate with portfolio balances, ostensibly incentivizing advisors to grow assets. It’s no surprise, then, that over 90% of registered investment advisors utilize this model, as reported by the latest InvestmentNews Benchmarking Study. Yet, the landscape is evolving rapidly, rendering the AUM model less indispensable as the primary revenue source for advisors. Two compelling reasons underscore this shift:

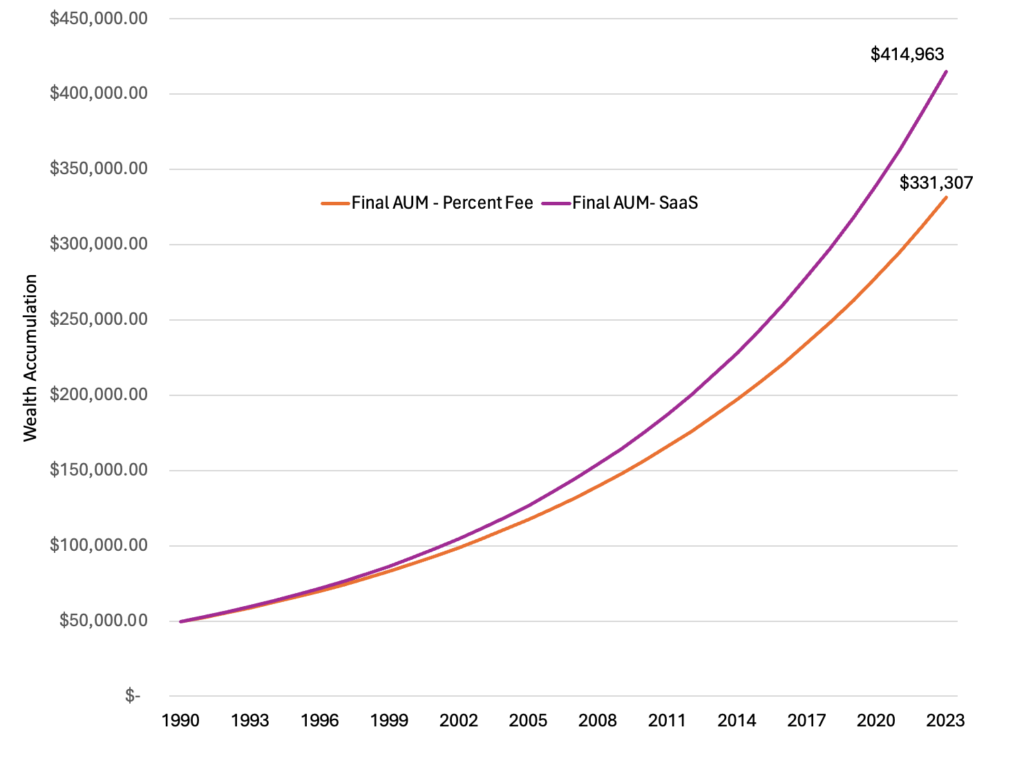

Expensive: AUM-based models often prove cost-intensive, chipping away at profit margins. Consider a scenario with an investment account: starting with a $50,000 investment in 1990, and assuming a 7% annual return until 2023. With a 1% AUM fee, your end portfolio value will reach $331,207, yielding a profit of $281,307. However, a staggering 20% of this profit ($51,348) is absorbed by fees. Elevate the fee to 1.5%, and a staggering 30% of your profits ($69,073) are diverted to the advisor.

In contrast, envision a subscription-based service charging $400/year. Over the same period, you’d pay $13,600 in fees, while your end portfolio value would have reached $414,010 even with similar annual returns on assets. Here, fees represent just 4% of your total profits.

Accessibility: AUM-based models may inadvertently direct advisors towards wealthier clientele, potentially distorting their focus. Consequently, 76% of households in the U.S. lack access to affordable and impartial financial guidance.

It’s about time for a departure from the status quo, and that is why at Alphanso, we practice subscription fee structures. By doing so, we can cultivate a more equitable and sustainable advisor-client dynamic. This approach detaches compensation from asset accumulation, enabling us to serve a wider range of clients effectively.