Introduction: The U.S. Treasuries market is a cornerstone of global finance, influencing investment strategies and economic policies worldwide. In recent months, this market has witnessed notable fluctuations, shaped by an array of macroeconomic factors and strategic moves by prominent investors.

Recent Movements: The U.S. Treasury market has been under the spotlight with yields, particularly the 10-year Treasury yield, experiencing significant volatility. As of late October 2023, the yield on 10-year Treasuries has surged to around 5%, a notable increase from previous levels. This shift is largely attributed to the Federal Reserve’s hawkish stance on inflation, resulting in a series of interest rate hikes to curb rising prices.

Yield on the 10-year Treasury note

Source: Tullett Prebon

Similar outsized moves took place in 2022, when inflation was rising sharply and the Fed was hiking rates. But inflation has cooled since then, and the Fed is proceeding cautiously. What’s behind the recent ascent? U.S. economic data continues to top forecasts. Although households have exhausted nearly all of their pandemic savings, retail sales rose for the sixth straight month in September, fueled by increasing real wages (i.e., after inflation). And initial jobless claims, a proxy for layoffs, fell to a nine-month low last week, signalling further strength in the job market. Also, a wave of long-term Treasury issuance has hit the market to fund an ever-growing federal deficit amid waning demand for Treasuries from the Fed, other central banks and foreign governments. All told, investors are now expecting a higher-for-longer interest rate environment.

Lessons From 1994

Much as in 1994, the rise in bond yields is associated with a tightening Federal Reserve interest rate cycle, and with concerns about the future of inflation. It may be tempting to buy a 20-year Treasury with a yield of more than 5.2 percent, with the intention of holding it to maturity. Whether that’s a brilliant purchase, or one you might regret in a few years because interest rates have moved much higher. But if it’s of any solace, people in 1994 didn’t know where the interest rates were heading, either. Most articles about bonds then were overwhelmingly negative. “A Painful Year of Higher Rates” was the headline of a representative New York Times article. In 1995, the Fed engineered a rare “soft landing” for the economy, quelling inflation without setting off a recession, and cutting interest rates. A soft landing is the Fed’s goal this time around, too. But, of course, we don’t know if it will get there. What’s inescapably true, however, is that for investors, interest rates are much more appealing than they were a few years ago. There might be better opportunities ahead, but this is already a good time to buy.

Supply and Demand Dynamics

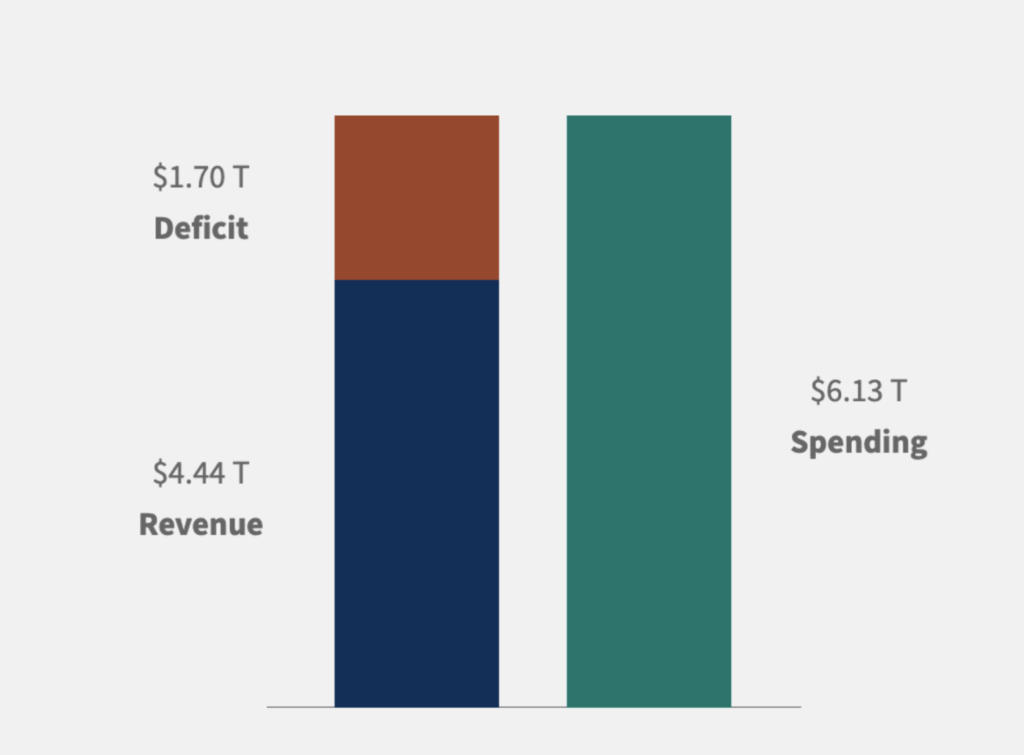

The balance between supply and demand for the U.S. Treasuries is crucial in determining market movements. On the supply side, the U.S. government’s need to finance a burgeoning deficit, projected at $1.7 trillion for the fiscal year 2023, has led to an increase in the issuance of Treasury securities. On the demand side, global uncertainties have propelled some investors toward safe-haven assets like the U.S. Treasuries. However, the anticipation of higher yields in the future has made others more cautious, creating a complex demand landscape. During the economic slowdown, it is anticipated that the deficit will further increase as the government seeks to accelerate spending with ambitious renewable energy targets, increased economic and infrastructure support, and an expanded defence budget.

U.S. Deficit Compared to Revenue and Spending, FY 2023

Source: US treasuries, September 2023

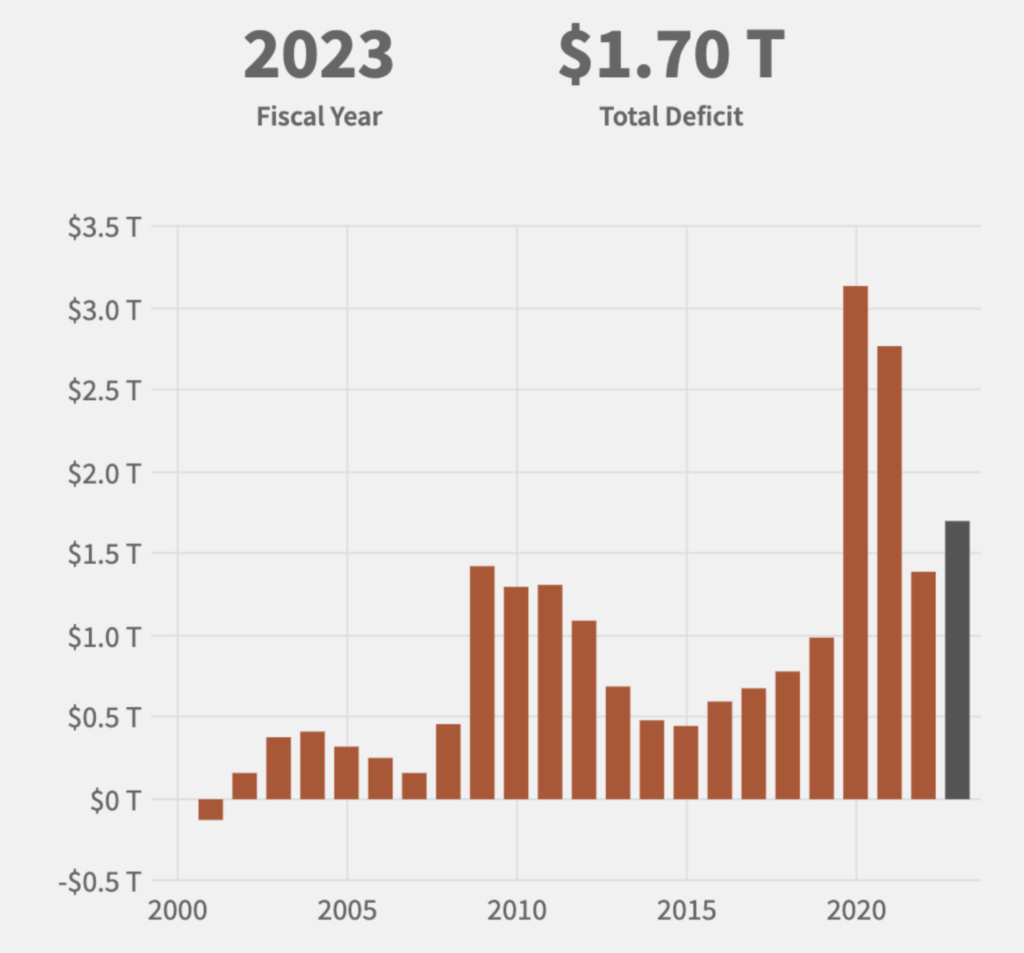

Federal Deficit Trends Over Time, FY 2001-2023

Source: US treasuries, September 2023

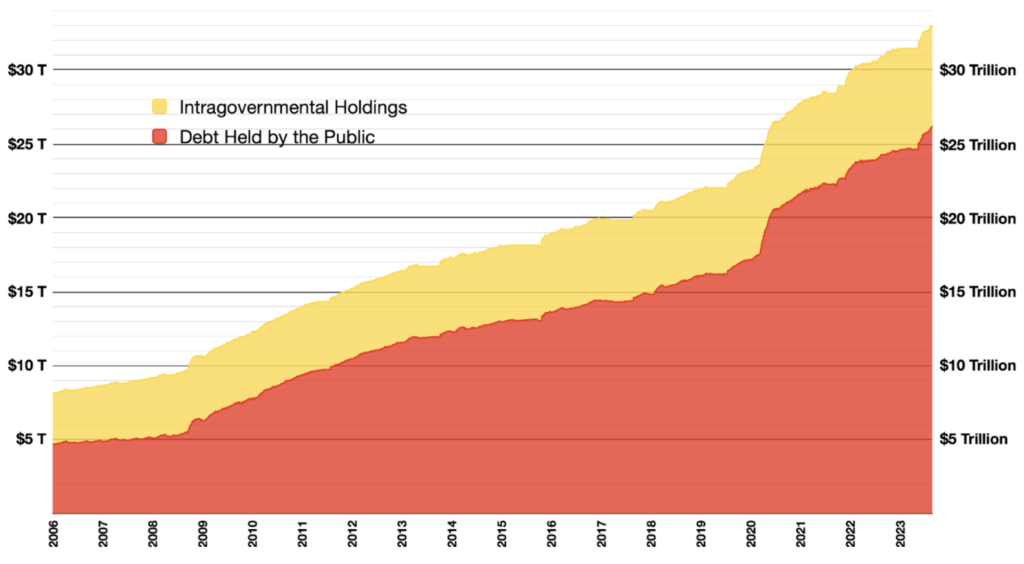

U.S. Debt Concerns

The burgeoning U.S. national debt, now exceeding $33 trillion, has resulted in a debt-to-GDP ratio of around 125%. This high level of indebtedness sparks concerns about the sustainability of the U.S. fiscal position in the long run and its implications for the Treasuries market.

National Debt of the United States

Source: Federal Reserve

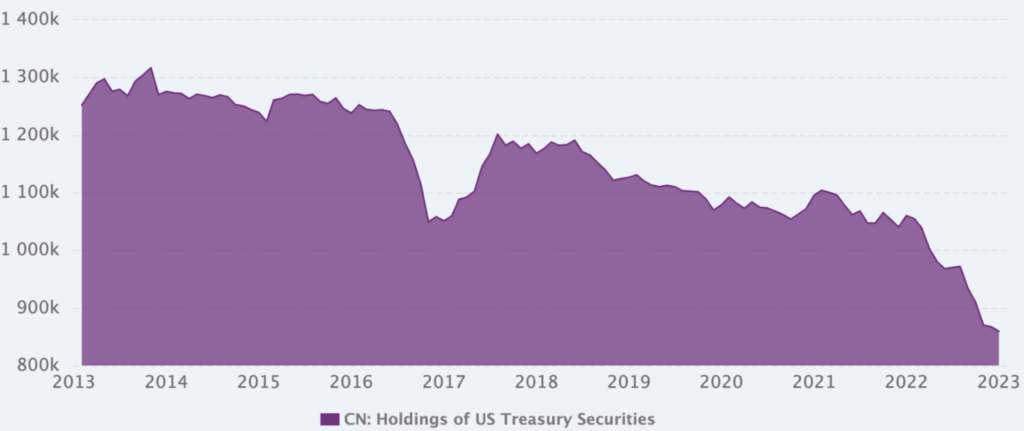

China’s Strategy

China, a major player in the U.S. Treasuries market has been gradually reducing its holdings adding to speculation that Beijing moved to give itself greater firepower in its defence of the renminbi. With a major sell-off of $15 billion in the past 10 days, current holdings stand at approximately $980 billion. This strategic sell-off is part of China’s broader plan to diversify its foreign exchange reserves, and it has significant implications for the demand and stability of U.S. Treasuries.

China’s Holdings of US Treasury Securities

Source: US Department of Treasuries

Hedge Fund Manoeuvres

Recently, some hedge fund managers have been taking bold positions in the U.S. Treasuries market. Notably, Bill Ackman, a prominent hedge fund manager, has expressed bearish views on U.S. Treasuries, anticipating that yields will rise even higher due to inflationary pressures and the Fed’s actions and made $200 million in about 4 weeks, although he has closed his position since, stating that there is way too much discrepancy in order to sustain the bet. Such short positions by influential investors add another layer of complexity to the Treasuries market, potentially exacerbating volatility and influencing price movements.

Forecast and Scenario Analysis:

Scenario 1: Continuation of Rate Hikes:

Should the Federal Reserve continue its rate hikes, we could see Treasury yields climbing further. This scenario could lead to a rotation out of stocks, particularly growth stocks, as higher yields make bonds more attractive and increase the discount rate used to value stocks.

Probability ~15%

Expected market movement (considering all other factors the same)

Next 3-6 months: -5% to -15%

Over 1 year: 0% to -5%

Scenario 2: Stabilisation of Inflation (Soft Landing)

If inflation stabilises sooner than expected, the Federal Reserve might halt rate hikes or even cut rates, potentially leading to a rally in both Treasuries (driving yields down) and stocks. This scenario could be particularly beneficial for growth stocks, which are more sensitive to interest rate changes.

Probability 69%

Expected market movement (considering all other factors the same)

Next 3-6 months 0% to 5%

Over 1 year: 8% – 12%%

Scenario 3: Economic Downturn (Hard Landing)

In the case of an economic downturn, we could witness a flight to safety, with investors piling into Treasuries, driving yields down. The stock market, however, might react negatively due to concerns over corporate earnings and economic stability.

Probability ~16%

Expected market movement (considering all other factors the same)

Next 3-6 months: -8% – 20%

Over 1 year: -5% to -15%

Impact on Stock Market:

U.S. Treasuries play a pivotal role in asset allocation decisions. The current rising yield environment is creating headwinds for stocks, especially growth-oriented sectors. A continuation of this trend could lead to further stock market volatility and potential declines. Conversely, stabilisation in the Treasuries market could provide respite to equities and potentially fuel a rally. The anticipated earnings yield for the next 12 months, based on consensus estimates, stands at 5.4%. In contrast, the current yield on Treasury Inflation-Protected Securities (TIPS) is only 1.9%. This means that the stock market is offering a relatively modest premium of just 3.5% when compared to the certainty of government bonds. In fact, this is the most conservative risk premium that the stock market has presented to investors in the past two decades, dating back to late 2003. As a result, stocks may appear less appealing compared to bonds. However, it’s crucial to note that the earnings yield does not always directly correlate with the overall performance of the stock market.

Conclusion: The U.S. Treasuries market is currently navigating through a turbulent phase, marked by volatility, increased supply, fiscal challenges, and strategic plays by prominent investors. The confluence of these factors makes it a critical time for investors, policymakers, and market analysts to closely monitor developments in this market, as it holds significant implications for the broader economy and financial stability.