This is the first part of our three-part series on navigating the high-yield credit market in 2024 and beyond. In this series, we’ll dive deep into the risks, strategies, and opportunities that investors face in this dynamic and often volatile market.

Part 1: “High-Yield Credit in Uncertain Times: Risks and Strategies for 2024 and Beyond” – We’ll explore the current state of the high-yield market, the factors driving uncertainty, and the key strategies investors can employ to mitigate risks and maximize returns.

Part 2: “US Junk Bond Market: Treading Carefully Despite Maturing Debt” – In this installment, we’ll focus on the US junk bond market, examining the impact of maturing debt on default rates and investor sentiment. We’ll also discuss the importance of careful credit selection in this environment.

Part 3: “Taming the High-Yield Beast: A Guide for Bond Investors in a Slowing Economy” – Our final piece will provide a comprehensive guide for bond investors navigating the high-yield market in a slowing economy. We’ll cover the role of central bank policies, the potential for spread tightening, and the key factors to consider when building a resilient high-yield portfolio.

Let’s get started!

The promise of high returns continues to draw investors to the high-yield credit market. However, navigating this market effectively requires a strategic approach, especially in a volatile economic climate.

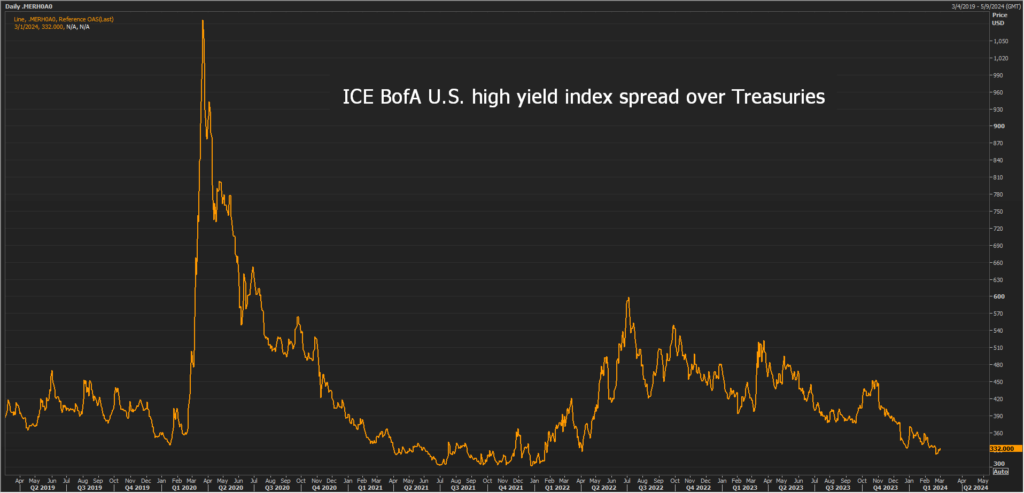

While 2023 saw uncertainty and inflation drive defaults in the ICE BofA High Yield Index up to 2.4% (compared to 1.5% in 2022), 2024 might present a different picture. Fewer bond maturities are anticipated, potentially leading to minimal payment defaults. Additionally, improved financial conditions have allowed issuers to access capital markets at reasonable rates, effectively tightening high-yield corporate bond spreads to 339 basis points by year-end.

In essence, the high-yield market offers the potential for significant returns, but investors must be strategic in their approach. Careful consideration of economic factors and a focus on issuer fundamentals are key to navigating this dynamic market successfully.

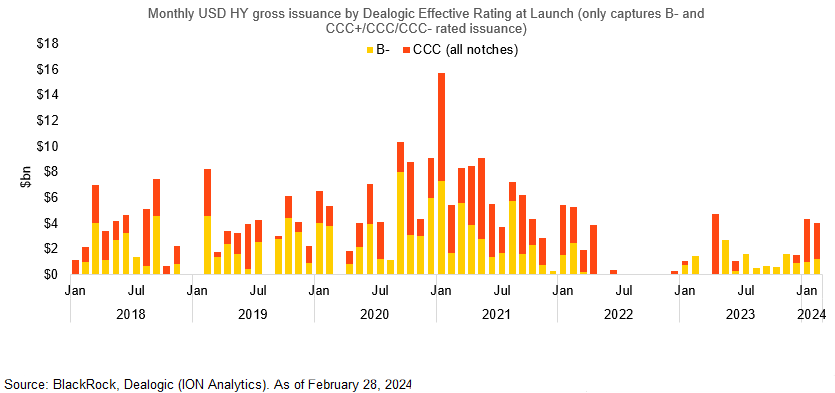

Don’t Expect Rock-Bottom Rates Again: Even with the Fed potentially loosening its grip, short-term interest rates are unlikely to revisit their historic lows. The composition of the high-yield market has also changed, with a rise in riskier single B-rated bonds and a decrease in safer BB-rated ones.

Defaults Remain a Concern, But Manageable: While 2024 might echo 2023 in terms of defaults, the projected par-weighted default rate of 2.5-3% suggests the high-yield market has built some resilience. This means defaults are still a possibility, but the overall impact should be contained.

Don’t Miss the Central Bank Cue: How Policy Impacts High-Yield Bonds

Central bank actions, especially those of the Federal Reserve, play a starring role in the high-yield market drama. Here’s what investors need to watch closely:

Interest Rate Decisions: The Federal Reserve’s recent message was clear: they’re committed to taming inflation with further rate hikes throughout 2024. The pace and extent of these increases will heavily influence borrowing costs and investor sentiment in the high-yield space.

Quantitative Tightening (QT): If central banks start selling off their bond holdings (known as QT), it could further squeeze liquidity in the market, potentially pushing yields higher. Stay tuned for any announcements about QT, as it could have a significant impact on high-yield bonds.

You can read part 2 here and part 3 here.

This is not financial advice. The views and opinions expressed are personal and do not necessarily reflect the views or positions of Alphanso or any entities they present.