Introduction

In the world of semiconductors and technology, few names resonate as strongly as Intel. For decades, Intel remained a crown jewel of America, pioneering the microprocessor that powered the digital era. Nevertheless, history has demonstrated that even giants like Intel can falter, and their descent can be as striking as their ascent.

Rise of Intel

Intel was co-founded by the legendary engineer Gordon Moore, known for “Moore’s law”. People in the technology industry relied on “Moore’s Law,” which said the amount of computing power would double and become cheaper at predictable intervals, roughly every two years. Engineers, especially at Intel, took pride in regularly delivering smaller transistors.

The personal computer (PC) era began in the early 1970s with the release of the Altair 8800 kit computer. However, it wasn’t until the early 1980s that PCs gained popularity for home and business use, largely due to the introduction of the IBM PC in 1981, which utilized Intel’s x86 microprocessor.

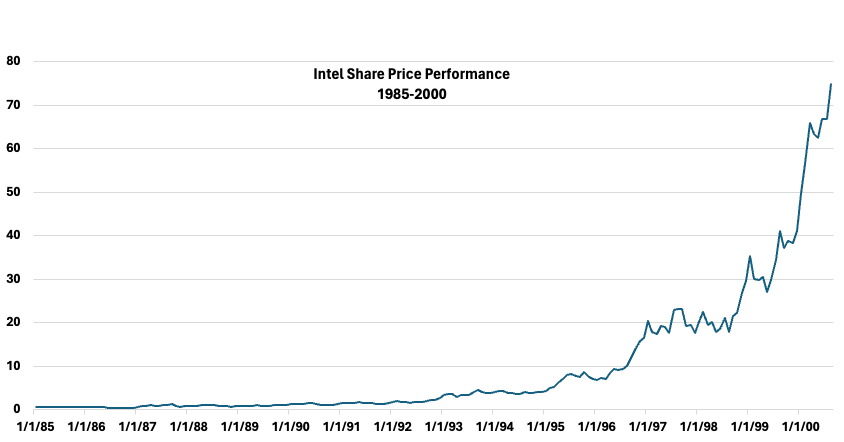

As the PC market rapidly expanded throughout the 1980s and 1990s, Intel’s profits soared. The company also diversified into other markets, such as servers and networking equipment.

Intel’s x86 architecture quickly became the industry standard for PCs, cementing Intel’s dominance in the PC microprocessor market for decades. As a result, Intel’s stock price skyrocketed from just $0.65 in 1985 to $74.80 at the peak of the Dot-Com era in 2000.

Missed Opportunity

The new century heralded the era of the mobile revolution. However, Intel missed a pivotal opportunity to supply the processor for Apple’s iPhone. In 2005, Steve Jobs approached Intel to gauge their interest in making chips for the iPhone. Intel declined the offer, mistakenly believing the iPhone would be a niche product and that the mobile market was not worth pursuing.

This miscalculation paved the way for the rise of ARM architecture chips, which have since become the standard in the mobile industry. It also provided Qualcomm with the perfect opportunity to dominate the mobile chip market.

The Onset of Decline

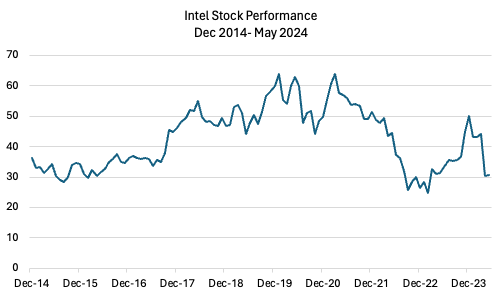

Twenty-two years later, Intel has yet to regain the market capitalization it boasted during the Dot-com era.

While Intel’s profitability was evident, its growth remained notably stagnant compared to its earlier successes. The company’s leadership has been subject to criticism. From Paul Otellini, who lacked a technological background, to Brian Krzanich, whose tenure was marked by drama and stagnation, Intel’s upper management failed to sustain the company’s innovative edge and competitive position.

By the early 2010s, even Intel’s focus on the processor market began to lag behind its competitors. In 2015, it became apparent that Intel’s 10nm process was delayed, resulting in the company extending the use of its 14nm process for its most crucial PC and server processors longer than anticipated. These delays accumulated, culminating in Intel missing deadlines for its next process, 7nm. The revelation of these issues in a 2020 earnings release caused Intel’s stock to plummet, ultimately paving the way for Gelsinger, a former Intel engineer, to assume leadership.

Before Gelsinger’s return to the company in 2021, Intel, once synonymous with “Silicon Valley,” had ceded its position in semiconductor manufacturing to overseas competitors like Taiwan Semiconductor Manufacturing Company ($TSMC). While Intel struggled to maintain its momentum, Advanced Micro Devices ($AMD), its long-standing rival in server and PC chips, capitalized on the situation. AMD leveraged TSMC to manufacture the chips it designed. Unlike Intel, TSMC didn’t encounter the same setbacks with 10nm or 7nm processes. Consequently, AMD’s chips became increasingly competitive, if not superior, to Intel’s, particularly for certain tasks, during the latter half of the decade. AMD, which had a minimal market share in server CPUs just a decade prior, captured over 20% of server CPU sales in 2022. Furthermore, in the same year, AMD surpassed Intel’s market capitalization.

Present and Future Uncertainty

Despite the massive chip shortage that should have been a golden opportunity for Intel, the company has been struggling to keep up with competitors like AMD and Nvidia.

Intel is not at risk of going bankrupt; they still make tens of billions in profit. However, they are no longer the dominant player in the semiconductor industry. The best-case scenario for Intel seems to be maintaining its market share, as the days of its dominance are long gone. For decades, it was the largest semiconductor company in the world by sales but suffered seven straight quarters of revenue declines recently.

Gelsinger is betting on a risky business model change. Not only will Intel make its own branded processors, but it will act as a factory for other chip companies that outsource their manufacturing — a group of companies that includes Nvidia, Apple and Qualcomm. Its success in acquiring customers will depend on Intel regaining “process leadership,” as the company calls it.

However, TSMC’s best chips use a 3-nanometer process. Intel is currently at 7-nanometers. Nanometers are 1,000 times smaller than micrometers.

Almost all Nvidia GPUs used for AI are made by TSMC in Taiwan, using leading-edge techniques to produce the most advanced chip.

The U.S. government is subsidizing a massive Intel fab outside of Columbus, Ohio, as part of $8.5B in loans and grants toward U.S. chipmaking. Gelsinger said last month that the plant will offer leading-edge manufacturing when it comes online in 2028, and will make AI chips — perhaps those of Intel’s rivals, Gelsinger said on a call with reporters in March.

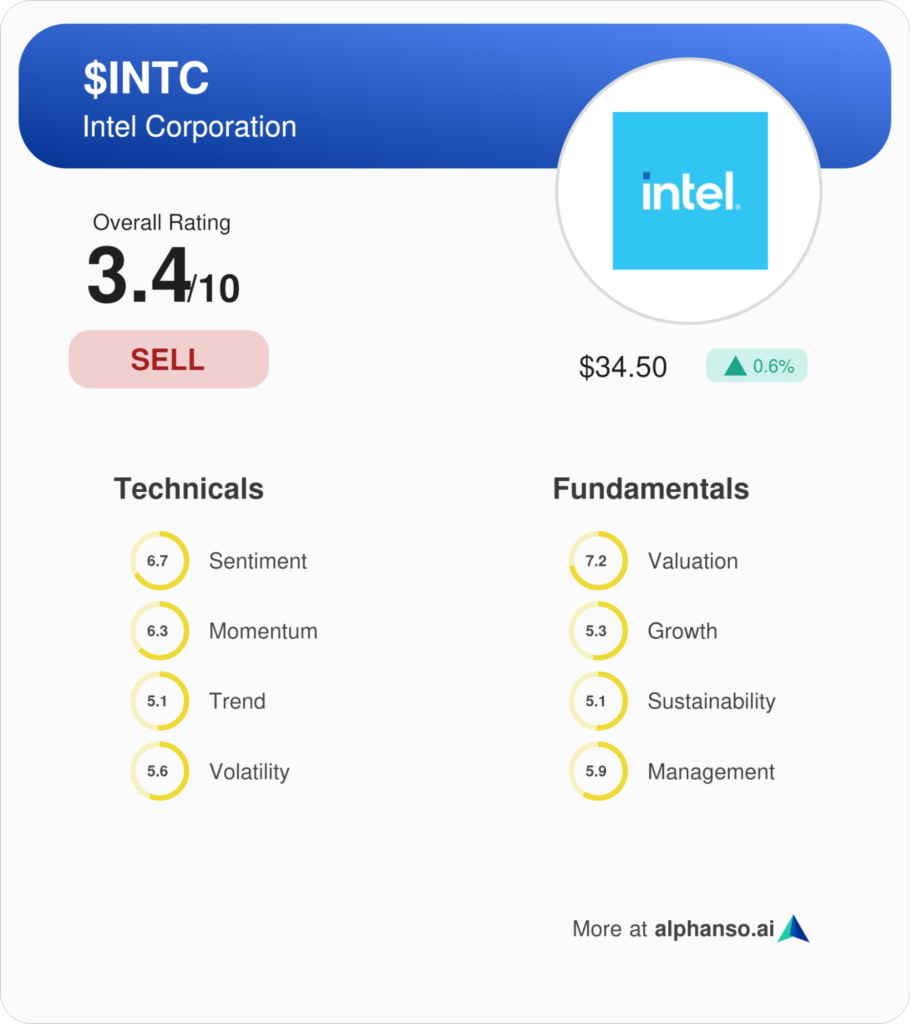

Alphanso Rating

Alphanso remains skeptical, assigning Intel a sell rating with a score of 3.4 out of 10. Intel is the worst performing tech stock in the S&P 500 this year, experiencing a decline of 37%. Meanwhile, the top performers in the index are chipmaker Nvidia ($NVDA) and Super Micro Computer ($SMCI), which has benefited from the soaring demand for Nvidia-based artificial intelligence servers.

Intel faces a formidable challenge in catching up and surpassing its competitors, with its financials showing signs of deterioration despite backing from the US Government.