February concluded on a high note in the markets, propelled by robust earnings and a resilient economy. The S&P 500 index surged by 5.3% over the month with the breadth of the rally remaining relatively limited. Notably, Nvidia, Meta, Amazon, and Microsoft collectively accounted for 45% of the total return.

The US 10-year Treasury yield climbed 29 basis points to 4.25% as hopes of a near-term rate cut faded.

It was another good month for the US economy. With over 90% of S&P 500 firms having reported, nearly three quarters have beaten analysts’ earnings forecasts. Economic data also proved resilient, with the US composite Purchasing Managers’ Index (PMI) suggesting activity continued to expand over February and the US economy adding 353,000 jobs in January.

Elsewhere, commodities lost ground, with the broad Bloomberg Commodity Index falling 1.5% over February as gas and agricultural prices continued to drop.

Considering the economic resilience and the most recent inflation metrics, the Fed is in a position to exercise patience in determining the appropriate timing for interest rate reductions. Nevertheless, our models persist in investing in high-quality companies with solid financial foundations, given the sustained elevation in earnings projections.

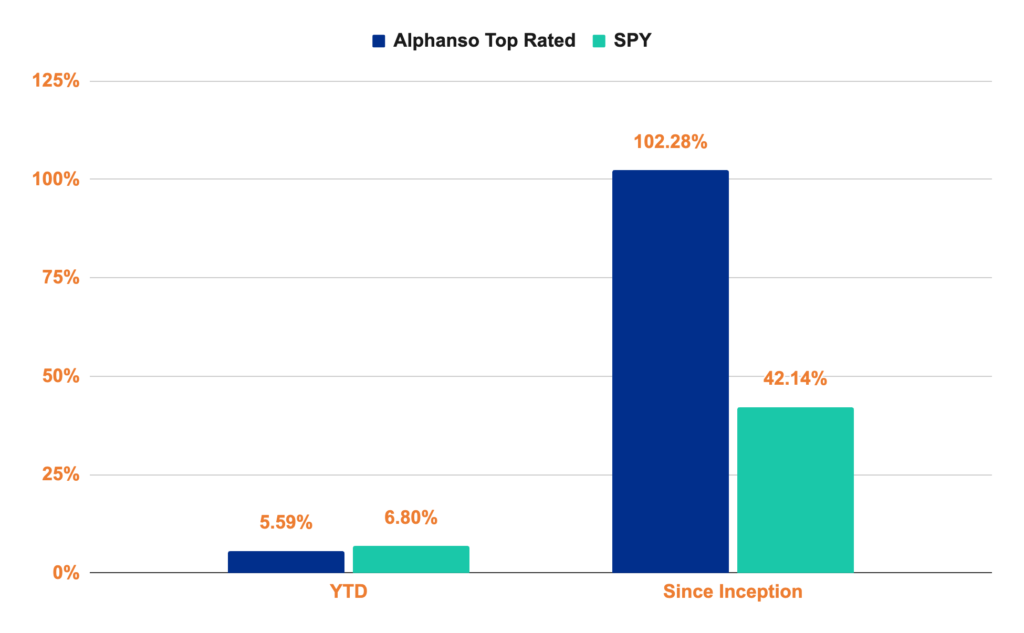

Alphanso Performance Update

Alphanso’s top-rated stock portfolio had another strong month gaining 4.73%.