Due to the United States’ inability to cover its debt interest without resorting to default or further borrowing, the government must implement austerity measures. These measures include cutting spending and raising taxes, which previously fueled economic growth and market stability.

The Current Landscape of Rising Debt

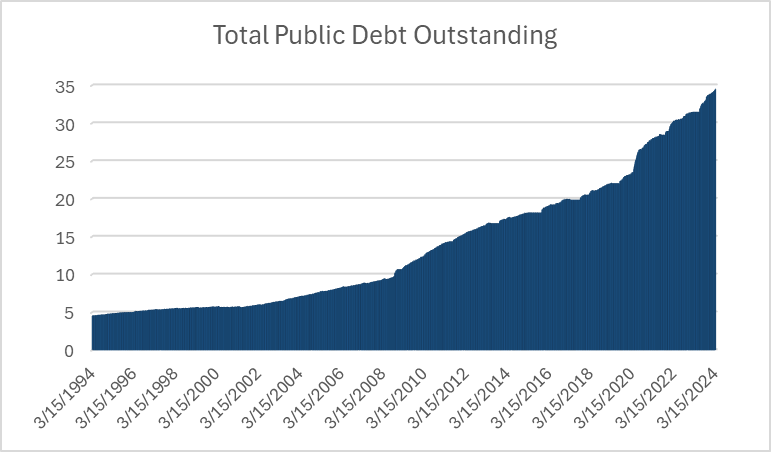

U.S. debt, the amount of money the federal government borrows to cover operating expenses, currently stands at over $34.4 trillion, according to data from the U.S. Department of the Treasury. The debt load of the U.S. has been growing at an accelerated pace in recent months, increasing by approximately $1 trillion every 100 days. Before 2023, reaching the $1 trillion mark took about 8 months. Bank of America investment strategist Michael Hartnett predicts that this 100-day pattern will persist as the debt climbs from $34 trillion to $35 trillion.

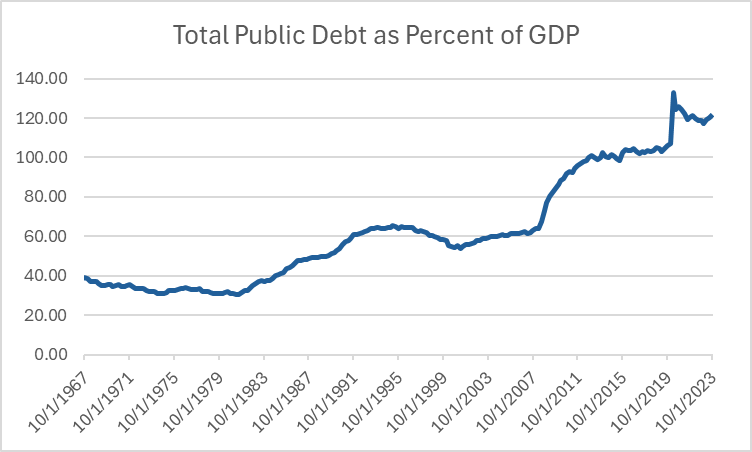

The federal government borrows money when its spending exceeds its revenues. Recent major events driving up debt include the Afghanistan and Iraq Wars, the 2008 Great Recession, and the COVID-19 pandemic. Spending surged by approximately 50% from FY 2019 to FY 2021, mainly due to COVID-19. Tax cuts, stimulus programs, increased spending, and reduced tax revenue from high unemployment contribute to debt spikes. Debt growth relative to GDP is influenced by interest rates and past debt levels. The Congressional Budget Office forecasts that debt held by the public will rise further, reaching 100.4% of GDP in 2024 and 108.9% five years later.

An important question for investors is the potential impact of the rising national debt. What could it mean for fixed-income and equity portfolios?

Despite the escalating debt, the impact on the stock markets has been minimal, with record highs reached in 2024. But that could change and we reach unsustainable debt levels.

Implications of Rising Debt for General Investors

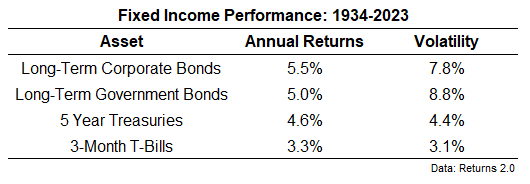

More government bonds cause higher interest rates and lower portfolio returns.

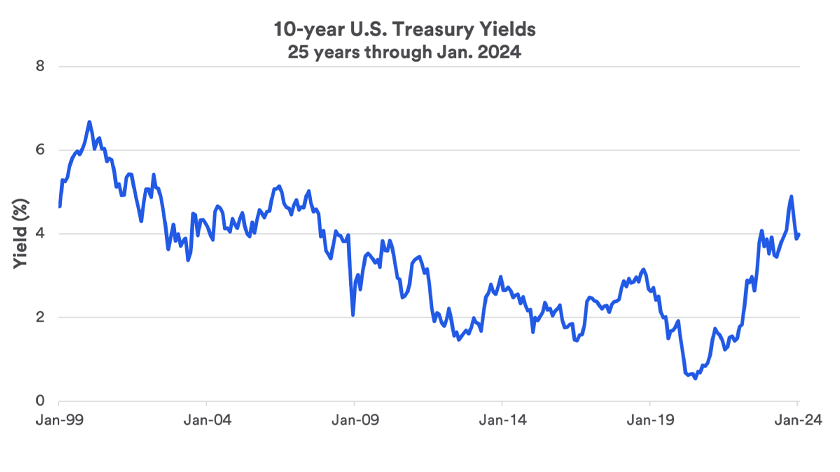

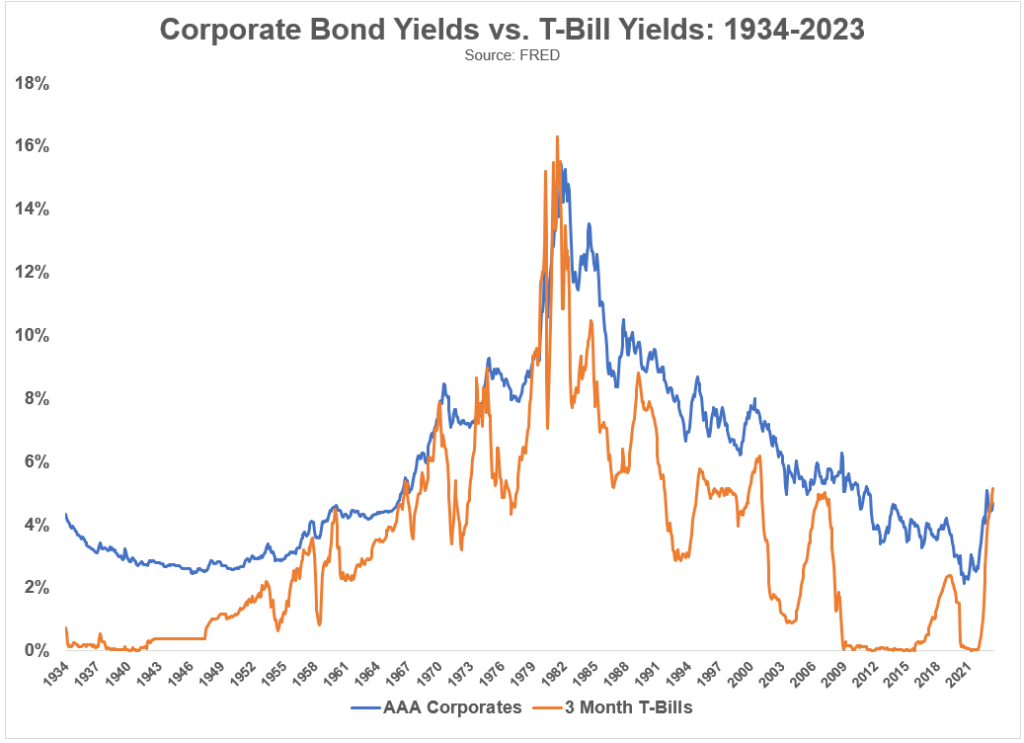

- Interest Rates Going Upwards – If the supply of Treasury securities continues to expand to finance growing government debt, there is a risk of upward pressure on interest rates. As the government issues more debt, investors typically demand higher returns due to concerns about potential default and the principles of supply and demand. This increased demand for returns leads to higher interest rates as the supply of debt rises.

As interest rates increase, the cost of maintaining the national debt also increases. As of February 2024, it costs $433 billion to maintain the debt, which is 16% of the total federal spending in fiscal year 2024.

- Default Risk of Bonds and Price Drop – While bonds offer investors the advantages of cash preservation and fixed income, they also entail interest-rate risk. Bonds and interest rates typically have an inverse relationship: when interest rates increase, newly issued bonds become more appealing to investors due to their higher yields, causing the prices of existing bonds to decline.

- Negative Impacts on the Stock Market – Rising interest rates have the potential to impede corporate borrowing activity, posing a challenge to business expansion and overall economic growth. As interest rates go up, it costs companies more to borrow from banks. This means they can’t invest as much in their businesses, which slows down their growth. Also, the situation in the bond market would be tough. When interest rates get higher and default risks become higher, investors prefer government bonds over riskier corporate bonds. So, companies have to offer even higher rates to attract investors, leaving less money for business growth. This slowdown in growth can then affect long-term stock prices.

Corporations are hit by national debt-induced rising interest rates from another side. With less money in the market, consumers’ budgets get tighter, and so do their purse strings. When people stop spending on goods and services, company revenues take a hit.

In addition, more federal revenues must be directed toward debt repayment when interest payments increase, leaving less money for other economically stimulating activities. The government will pay a record $870 billion in interest payments in 2024 and $12 trillion in the next 10 years.

This can only be achieved via tax increases, spending cuts, or more debt all of which can inhibit economic growth and dampen market stability.

Heightened government borrowing can also trigger a crowding-out effect, raising interest rates for businesses and consumers, potentially dampening private sector investment and consumption, crucial for economic growth.

On August 1, 2023, Fitch Ratings took the significant step of downgrading the United States’ Long-Term Foreign-Currency Issuer Default Rating (IDR) from AAA to AA+. This action was prompted by concerns about the “high and growing general government debt burden.” Fitch’s decision was fueled by their prediction of a fiscal decline over the subsequent three years. They also highlighted a concerning trend in governance regarding fiscal and debt matters, noting a steady deterioration over the past couple of decades. It’s imperative to recognize that any further deterioration in the US credit credibility could lead to additional downgrades in US bond ratings.

Practical Tips and Advice for Investors Amidst Rising Debt

The bright side is that the U.S. position relative to the global economy remains strong, which allows the federal government more time to address the debt situation before it results in significant economic ramifications.

While it could create some challenges for the stock and bond markets to grow over the short period, the long-term story remains intact, especially for the equity markets.

In these times, it’s essential to adopt a more balanced approach to investing. Our focus should be on identifying competitive yet high-quality businesses that are reasonably priced and possess strong cash flow generation. Additionally, strategic sector allocation can play a pivotal role in achieving alpha over the short term. For example, prioritizing sectors less sensitive to interest rates can yield greater benefits.

At Alphanso, our mission is to align your investments with the most promising opportunities available in the current market landscape. We recognize that every investor has unique needs, and we strive to address them personally and comprehensively. To discover which investments align best with your financial goals, download the Alphanso app.