Q2 2024 concluded on a positive note in the financial markets, driven by strong corporate earnings and anticipation of imminent interest rate cuts. The S&P 500 index surged 3.3% in June, bringing its year-to-date gains to 14.4%.

The second quarter started off rocky for both stocks and bonds amid concerns that the Federal Reserve might delay rate cuts due to persistent inflationary pressures. However, sentiment improved towards the end of the quarter as inflation data showed signs of improvement, bolstering expectations that the Fed would move to lower rates starting in September. Additionally, soft consumer data further fueled optimism for potential easing measures, with the rates market indicating expectations of two cuts by year-end.

Companies involved in artificial intelligence continued to lead the market, with an attribution analysis highlighting that without contributions from Nvidia, Apple, Microsoft, Alphabet, and Broadcom the broad market index would have fallen this quarter.

In other market movements, the US 10-year Treasury yield fell by 15 basis points in June to close at 4.36%. Oil prices and Bitcoin saw declines of 2.6% and 13.6% respectively, while Gold and Copper prices posted gains of 4.1% and 8.5% respectively in Q2 2024.

Q3 2024 Outlook

The ongoing economic resilience continues to underpin an upward trajectory, bolstering the case for a soft landing scenario. Currently, the forward 12-month P/E ratio for the S&P 500 stands at 24.17, significantly above its 5-year average of 19.1 and its 10-year average of 17.7. With market valuations surpassing historical norms, the sustainability of this momentum will hinge heavily on corporate earnings, particularly within the technology sector.

Investor scrutiny is increasingly focused on how tech companies are capitalizing on their investments in artificial intelligence, a critical factor influencing current stock prices. Projections indicate a robust outlook, with expectations for S&P 500 earnings to climb 11.3% in 2024 and further by 14.4% in 2025. Despite this positive forecast, the elevated valuations suggest that U.S. stocks are fully priced, suggesting a potential limit on broader market returns.

In response, a discerning strategy is advisable, emphasizing stocks with strong financial fundamentals and sustained growth prospects in earnings.

Alphanso Performance Update

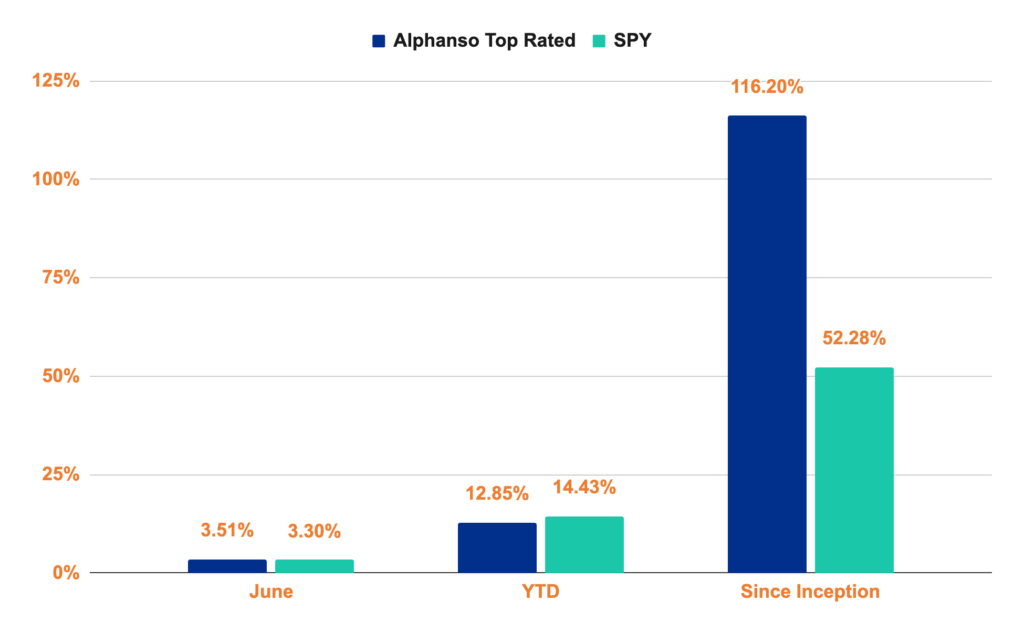

Our top-rated stock portfolio had another strong month gaining 3.5% in June. The gains were led by technology stocks, notably Crowdstrike (CRWD) and Fair Isaac Corp (FICO).