NVIDIA: The AI Revolution’s Driving Force

From GPUs to AI, discover NVIDIA’s remarkable journey and the wealth it created for investors. Learn how supercomputers, generative AI, cryptocurrency, and the metaverse propelled its rise.

NVIDIA’s Journey in Technology Evolution

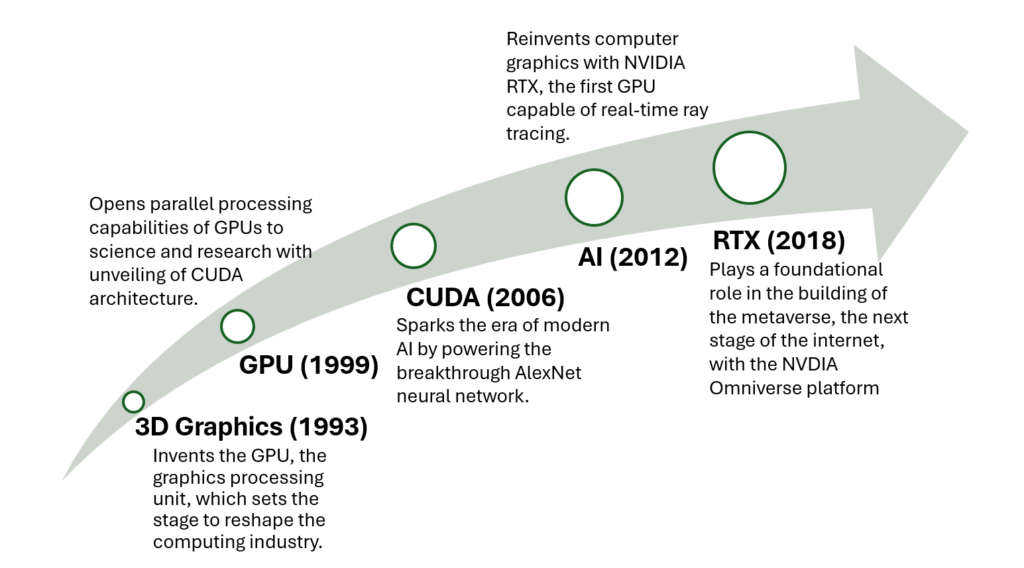

The whole story began with a 3D Graphics vision established in 1993. Six years later, NVIDIA’s invention of the GPU in 1999 sparked the growth of the PC gaming market, redefined modern computer graphics and revolutionized parallel computing. GPUs are computer chips or semiconductors that use math operations to produce visuals and images. The GPU manages and speeds up graphic workloads and displays visual content on a device such as PC or smartphone.

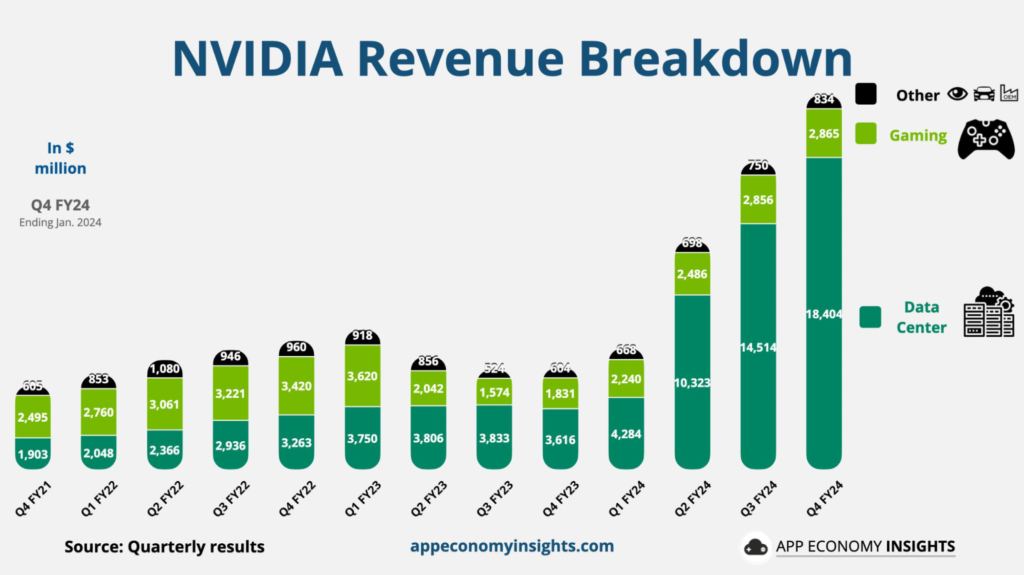

The evolution of NVIDIA’s revenue streams over time. Initially, gaming was the main source of revenue for NVIDIA, with GPU chips primarily used for gaming purposes. As of Q4 2021, although gaming still contributed significantly to their revenue (50%), the data center segment also played a substantial role, comprising 38% of their total revenue. With the rise of Artificial Intelligence, the Data Center segment has become the primary revenue driver for NVIDIA. This shift is evidenced by Gaming revenue dropping to 17% of NVIDIA’s FY2024 overall revenue in their latest report, while Data Center revenue growing to 78% of overall revenue, which totaled $47.5 billion.

More recently, GPU deep learning ignited modern AI – the next era of computing – enabling programs to perceive and understand the world as Apollo inspired the Oracle of Delphi. Nvidia has grown to be the world’s largest producer of GPUs.

For more than 30 years, scientists, researchers, developers, and creators have been using NVIDIA technology to do amazing things. More than 4 million developers now create thousands of applications for accelerated computing.

Key Factors of NVIDIA’s Rise

The Tide of Supercomputers

NVIDIA’s rise owes much to its role in powering supercomputers. These powerful machines, with NVIDIA GPUs inside, handle big data crucial for cutting-edge tech like AI. Companies like Meta use NVIDIA’s tech for AI research. Tesla is also planning to boost its cars with AI-focused supercomputers. This move into supercomputing has helped NVIDIA grow and cement its reputation as a tech innovator across industries.

Generative AI Has Become The Essential

With the rise of generative AI, advanced chips like A100 can handle the vast volumes of data required to train such generative AI programs as ChatGPT and Gemini. Having already established a strong presence in this sector prior to the surge in demand for AI technology, Nvidia further solidified its position as demand skyrocketed. Throughout 2023, Nvidia consistently surpassed expectations in its earnings reports, fueled by the growing momentum and attention surrounding AI.

Cryptocurrency Contributed To Some More Success

Cryptocurrency proved a hit in the past few years.The mining of digital currencies like Bitcoin and Ethereum, became a significant factor in NVIDIA’s rise due to the high demand for GPUs to perform mining operations. Cryptocurrency mining requires substantial computational power, making GPUs well-suited for the task. This giant has been selling the proverbial picks and shovels to the AI gold rush.

The Emerging Techniques Like Metaverse And XR

These strong cards such as GeForce RTX 4070, also help power video games at a higher resolution and quicker speed. Taking a further step into the changing world of the metaverse and XR, Nvidia offers 3D modeling programs to help stream extended reality (XR) content efficiently, enhancing the augmented reality landscape with its Omniverse platform.

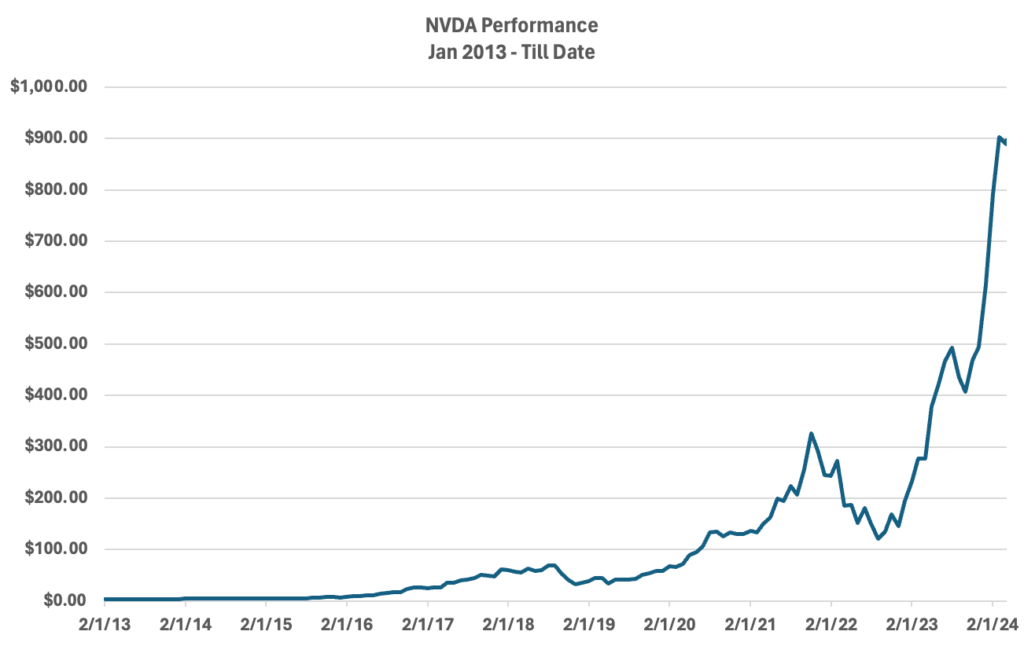

Nvidia’s Legendary Gift to its Long-Term Shareholders

No other stock has symbolized the enthusiasm for artificial intelligence in the U.S. market quite like Nvidia, leaving Wall Street tethered to the unpredictable fluctuations of its volatile shares. In 2023 alone, Nvidia shares experienced a threefold increase, and this year, they have surged by almost 40%, driven by mounting anticipation of the business prospects in artificial intelligence. With a market capitalization of $2.4 trillion, Nvidia ranks as the third most valuable company globally, trailing only Microsoft (MSFT) and Apple (AAPL).

Not too long before the dot-com bubble burst in 2000, Nvidia made its grand entrance as a publicly traded company. Its initial public offering (IPO) occurred on Jan. 22, 1999, with shares being sold at $12. Of course, a lot has changed since then.

IPO-day investors have seen their share count in Nvidia grow by a factor of 48. At the same time, the IPO offering price has been reduced to a split-adjusted $0.25 per share. Based on Nvidia’s closing price of $950.02 on March 25, 2024. For those of you keeping score at home, Nvidia has produced a 380008% gain since its IPO, which compares to just a 409% return for the benchmark S&P 500 over the same period. This extraordinary growth highlights Nvidia’s remarkable ability to adapt and excel in an ever-changing technological environment, cementing its position as a leader in the industry.

During the company’s early days, however, the company suffered from a lost half-decade despite significant spikes in the early 2000s. Tech companies, including Nvidia, weathered a difficult period marked by economic downturns, intensified competition, and technological shifts, presenting a myriad of challenges. Despite the technological advancements made during these years, the company struggled to translate these innovations into consistent financial gains, leading to a stagnant period for its stock price.

Following the hardship, a viberant spring came. Since August 2004, the company’s stock price has skyrocketed by an astonishing 914-fold, climbing from $1.04 per share to its current value.

Every evolution of the internet presented Nvidia with a historic opportunity to innovate and redefine its role in the rapidly evolving technological landscape. With each advancement, Nvidia leveraged its expertise in chip design and computing power to stay at the forefront of emerging trends and capitalize on new market opportunities. From the rise of cloud computing to the advent of artificial intelligence and the growth of the metaverse, Nvidia continually adapted its products and strategies to meet the demands of the digital age, cementing its position as a leader in the tech industry.

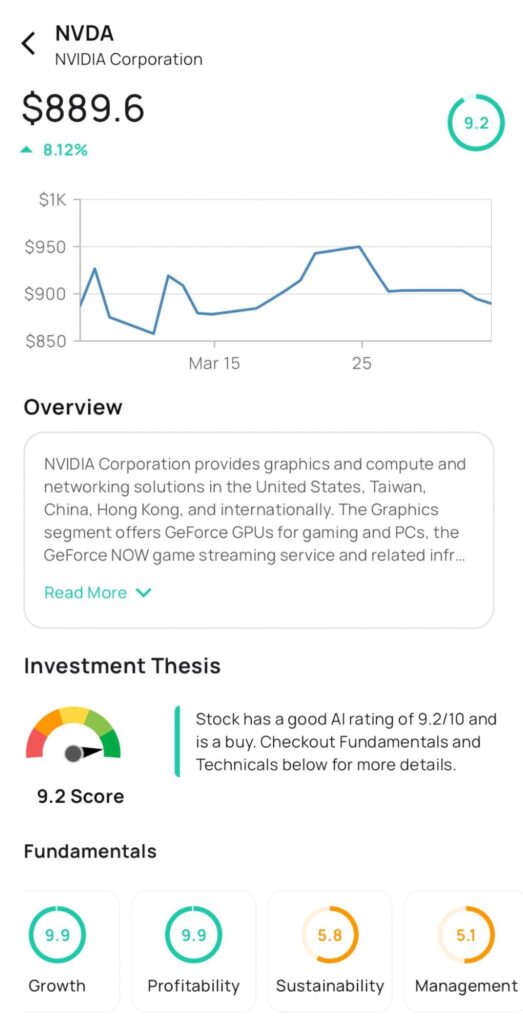

Alphanso rates Nvidia $NVDA a buy with a score of 9.2/10 as growth and profitability potential remains strong and sustainable.