Monopolies rule the internet. Alphabet owns search; Amazon runs e-commerce; Apple has the hardware; Meta controls social networking; and Microsoft dominates business software. These giants wield immense influence, commanding the online world. However, their dominance isn’t without challenges and concerns, necessitating a careful approach to investment decisions.

Historical Backdrop:

For two centuries, U.S. policies upheld decentralised media and protected free speech. Yet, a significant shift occurred in the late 1970s when Wall Street began shaping the media landscape. This trend accelerated dramatically with the Telecommunications Act of 1996. In newer industries, such as personal computing, concentration reached unprecedented levels as corporations locked users into their platforms.

Acquisitions have allowed these corporations to control the richest and widest data sets on human populations ever assembled. Their reach, combined with data, gives these platforms gatekeeping power over who wins and loses online. These advantages insulate them from basic market-based accountability mechanisms, like competition from rivals for users and advertisers. Facebook and Google can increase the number of ads in their services or reduce quality of products through elevated surveillance levels without consequence.

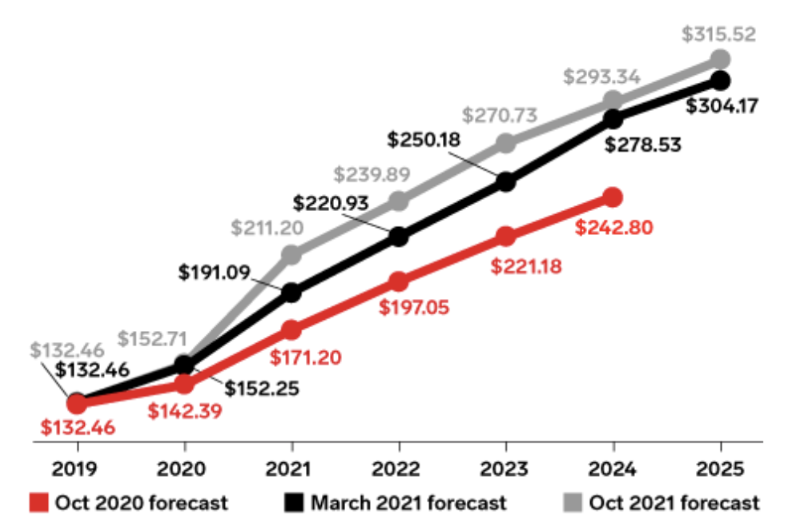

US digital ad spending will soar past $200 billion in 2021, marking 38.3% growth from 2020. The triopoly of Google, Facebook, and Amazon will make up 64.0% of all US digital ad spending this year, about the same share they possessed in 2020.

How has the US Digital Ad Spending Forecast Changed?, billions, 2019-2025

Source: eMarketer

During and after the pandemic, tech companies embarked on a spending spree, pouring billions into expanding their operations, developing new technologies, and meeting the increased demand for digital services. This fervour for growth seemed unstoppable, and the stock market reflected the optimism, pushing tech valuations to unprecedented heights.

However, as time went on, some tech giants faced the harsh reality that their extravagant investments didn’t always translate into sustainable profits. The consequences were felt in various ways:

First, shareholders witnessed the market’s volatility as overvalued tech stocks underwent corrections, causing fluctuations in portfolio values.

Second, employees experienced the brunt of these financial realities as companies initiated layoffs and restructuring efforts to control costs. These layoffs, despite the industry’s reputation for job security, left many skilled workers in the lurch and highlighted the uncertainty that can accompany rapid expansion and contraction in the tech sector.

In essence, the tech industry’s extravagant spending and subsequent layoffs were a stark reminder of the cyclical nature of markets, the importance of prudent financial management, and the far-reaching consequences of such decisions on both the stock market and the lives of countless individuals.

Where are we now?

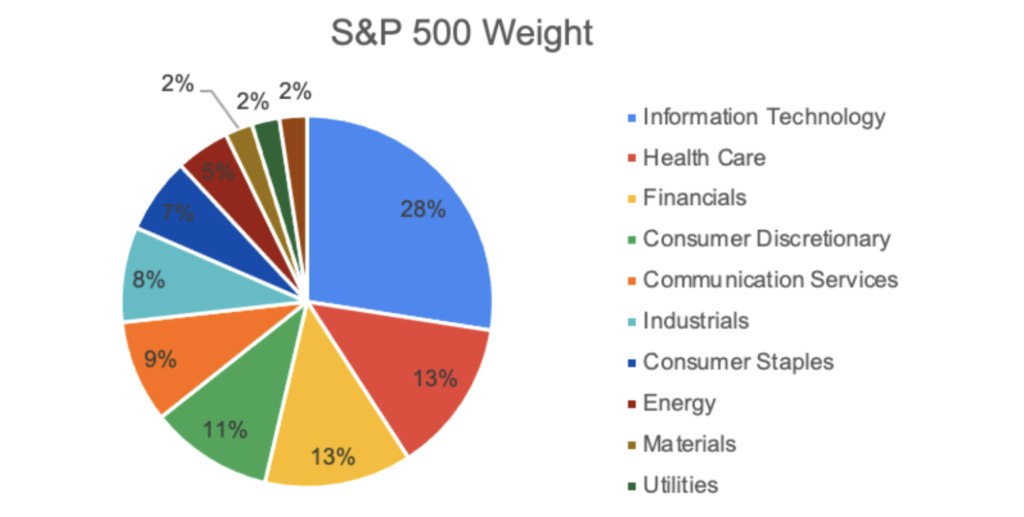

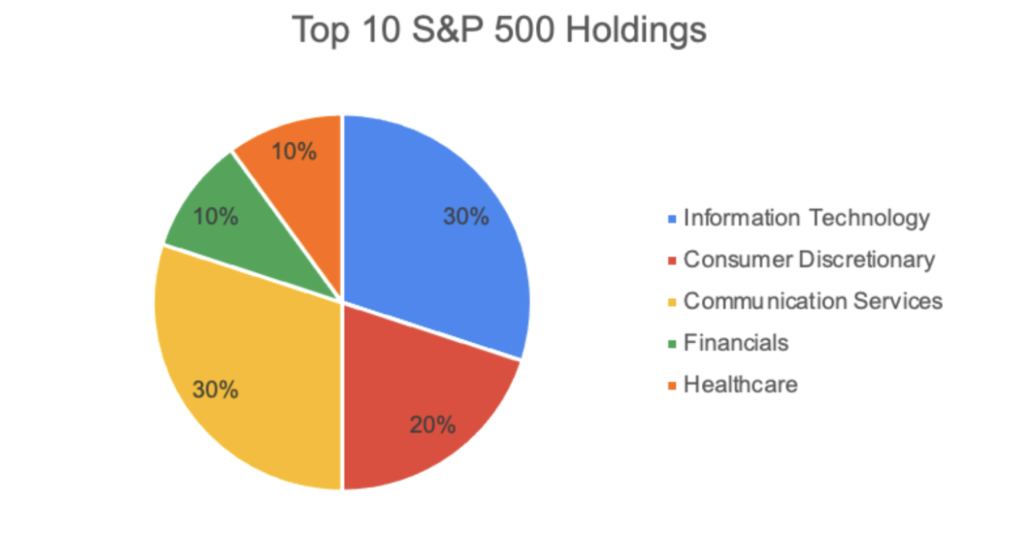

Currently, the Information Technology and Communication Services sector dominates market share. Specifically:

Source: S&P 500 Global

Source: S&P 500 Global

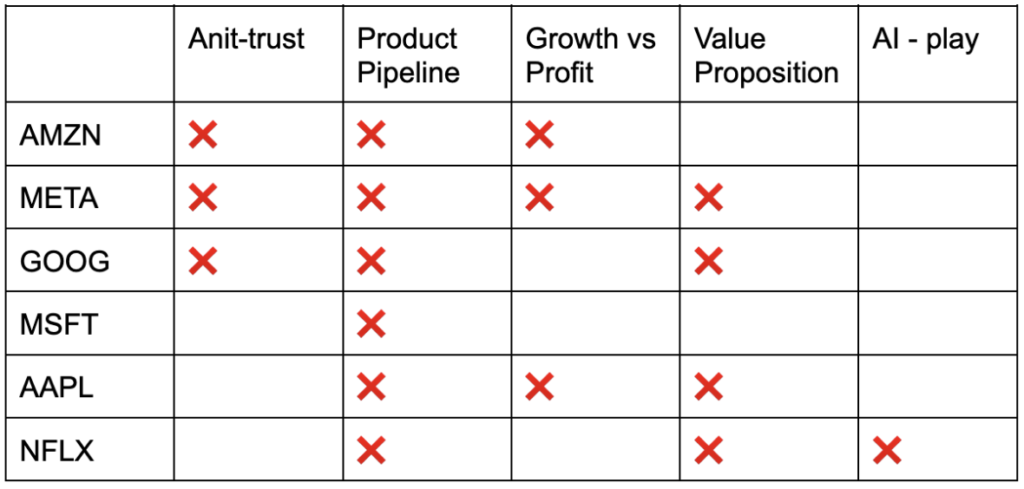

Downsides in FAANG:

Source: Alphanso Research

Source: Alphanso Research

- AMZN – Regulators are investigating Amazon for potential anti competitive behaviour, raising concerns about a possible breakup. The Federal Trade Commission (FTC) alleges that the company engaged in questionable practices, including enrolling consumers in its Prime paid subscription program without their explicit consent, creating obstacles for subscription cancellation, pressuring merchants to join its logistics program, and impeding lower prices on rival e-commerce platforms.

- META – Apart from the concerns surrounding antitrust issues, Meta’s heavy reliance on advertising revenue, which has constituted approximately 98% of its recent income, poses a significant dependency on this income stream.

- AAPL – There’s a notable challenge in the form of iPhone market saturation. In 2022, Apple sold an estimated 232.2 million iPhones, generating $205.5 billion in sales. However, the issue lies in the limited pool of potential new iPhone buyers, as the 2022 unit sales figures are not significantly different from the 231.2 million iPhones sold in 2015. Over two decades, Apple’s global dominance, significantly aided by China, has grown. Despite diversification attempts, over 95% of iPhones, AirPods, Macs, and iPads are manufactured in China. Recently, iPhone sales in China (24%) outpaced those in the US (21%), with China contributing 19% to Apple’s total revenue last year ($74 billion). However, escalating US-China tensions put Apple in a tough spot. A recent directive from the Chinese government barred employees from using or bringing iPhones to work. Although the immediate sales impact may be marginal, it reflects China’s broader aim to reduce reliance on foreign goods, encouraging citizens to choose domestic phones, thereby bolstering its economy.

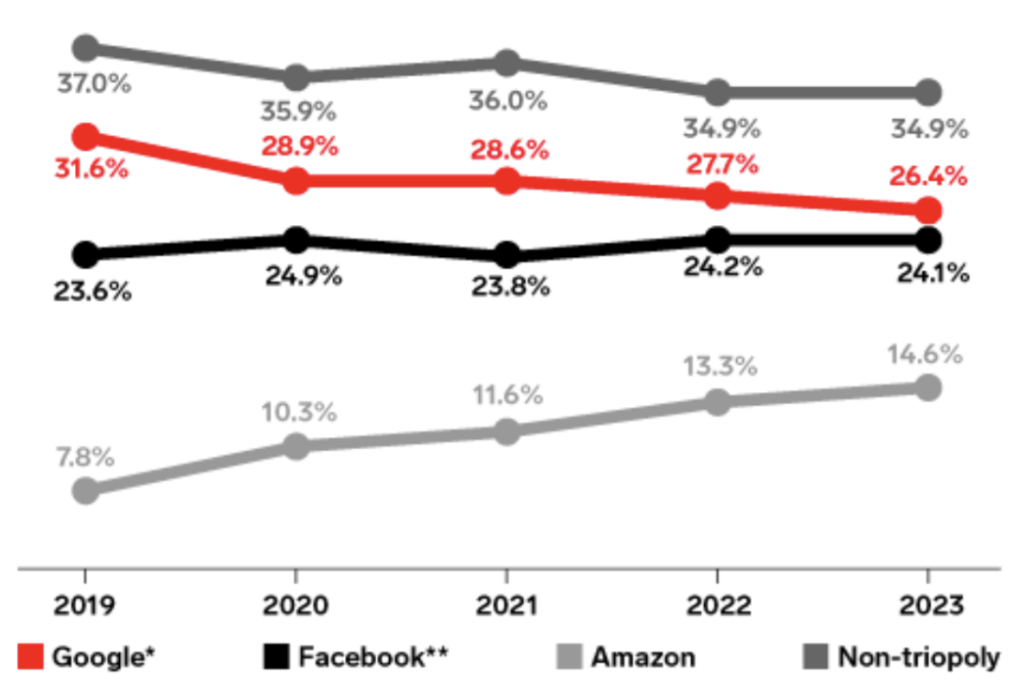

- GOOG – The Justice Department initiated a non-jury antitrust trial on September 12. The government accuses Google of upholding a monopoly in internet search by employing exclusionary distribution agreements that direct an enormous volume of search queries to Google daily. Despite its impressive profit margins and robust free cash flow, Alphabet, Google’s parent company, experienced a gradual decline in its online advertising market share, despite accounting for over 80% of its 2022 revenues.US Triopoly Digital Ad Revenue Share, by Company, 2019-2023, % of total digital ad spending

Source: eMarketer

- NFLX – Regarding Netflix (NFLX), the company was an early trailblazer in the streaming media landscape, capitalising on a significant first-mover advantage that lasted for several years. However, this competitive edge has waned considerably. The streaming market has grown crowded, with numerous paid services vying for viewership. Notable Netflix competitors include Prime Video (AMZN), Max (Warner Bros. Discovery Inc. – WBD), Hulu, Disney+ (The Walt Disney Co. – DIS), and YouTubeTV (Alphabet Inc. – GOOG, GOOGL). Furthermore, Netflix faces increasing competition for viewer engagement from social media platforms, such as TikTok, Twitter, and Instagram, as they incorporate more streaming video features.

- MSFT – Although MSFT has a diversified revenue base, it still contributes to duopoly in computer operating systems and gaming consoles. In the 1990s, Microsoft was involved in one of the most notorious antitrust cases in U.S. history. The company was accused of using its dominance in desktop software to push consumers to its internet browser, killing off competition from upstarts such as Netscape. The government won the case, ultimately forcing Microsoft to allow PC makers to use other companies’ browsers. Google singled out Microsoft in the complaint, arguing that through its dominant Windows Server and Microsoft Offices products, the company can make it difficult for its massive roster of clients to use anything but its Azure cloud infrastructure offering. Google described Microsoft’s licensing restrictions as a “complex web” that prevents businesses from diversifying their enterprise software vendors. In the UK, Microsoft and Amazon may face regulatory scrutiny for allegedly hindering UK consumers from utilising multiple cloud service providers. The Competition and Markets Authority (CMA) recently initiated a probe into the UK cloud infrastructure services market to investigate potential anti-competitive behaviours. Firms like Microsoft and Amazon Web Services (AWS) operate global data centers to provide remote computing services and storage, forming the backbone for developing and running software applications like Gmail and Dropbox. Last year Microsoft and AWS had a combined UK market share of 70-80%, with Google as the nearest competitor holding a 5-10% share.

The lessons of history

An asset bubble occurs when the price of a financial asset or commodity rises to levels that are well above either historical norms, the asset’s intrinsic value, or both. The problem is that since the intrinsic value of an asset can have a very wide range, a bubble is often justified by the flawed assumption that an asset’s intrinsic value has skyrocketed, meaning the asset is worth much more than it fundamentally is.

- In the United States, the term Nifty Fifty was an informal designation for a group of roughly fifty large-cap stocks on the New York Stock Exchange in the 1960s and 1970s that were widely regarded as solid buy and hold growth stocks, or “Blue-chip” stocks. These fifty stocks are credited by historians with propelling the bull market of the early 1970s, while their subsequent crash and underperformance through the early 1980s are an example of what may occur following a period during which many investors ignore fundamental stock valuation metrics, to instead make decisions on popular sentiment. Examples of Nifty Fifty stocks included household names such as General Electric, Coca-Cola, and IBM. However, part of this list also included now-struggling or defunct companies like Xerox and Polaroid.

- Japan’s economic bubble of the 1980s is a classic example. The yen’s 50% surge in the early 1980s triggered a Japanese recession in 1986, and to counter it, the government ushered in a program of monetary and fiscal stimulus. These measures worked so well that they fostered unbridled speculation, resulting in Japanese stocks and urban land values tripling between 1985 and 1989. At the peak of the real estate bubble in 1989, the value of the Imperial Palace grounds in Tokyo was greater than that of real estate in the entire state of California. The bubble burst in 1991, setting the stage for Japan’s subsequent years of price deflation and stagnant economic growth known as the Lost Decade.

- The Dotcom Bubble was characterised by excessive speculation in tech stocks, particularly internet-related companies. It burst in 2000, leading to significant market losses and the downfall of numerous tech startups. During the dot-com crash, many online shopping companies, notably Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Others, like Lastminute.com, MP3.com and PeopleSound, survived the burst but were acquired. Larger companies like Amazon and Cisco Systems lost large portions of their market capitalization, with Cisco losing 80% of its stock value.

Although every bubble is different, one common element in most bubbles is the willingness of participants to suspend disbelief and to steadfastly ignore the increasing number of cautionary signs. Another is that the bigger the bubble, the greater the damage it inflicts when it bursts. The underlying lesson remains the same: markets have a tendency to revert to the mean, and sectors that experience meteoric rises eventually face the gravity of normalisation. Investors would do well to heed these historical lessons and exercise caution, as irrational exuberance can lead to painful corrections.

As said by John Kenneth Galbraith, “There can be few fields of human endeavour in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present”

Investing recommendation

In today’s investment landscape, where the tech industry dominates but faces uncertainties, diversification is paramount. While tech has been a powerhouse, it’s wise to anticipate a potential slowdown. We recommend diversifying across sectors that historically outperform during high interest rates, inflation, and a strengthening US economy. Consider allocating assets to sectors like:

- Consumer Staples: covering essential items, is seen as a stable investment choice, maintaining demand during economic downturns..

- Energy: Supply constraints, erratic weather patterns continue to support, energy prices benefiting oil and gas companies.

- Materials: Inflation often drives up the prices of raw materials, making this sector appealing.

- Healthcare: This sector tends to be less sensitive to economic cycles, offering stability.

Remember, diversification spreads risk and can position your portfolio for success in diverse economic conditions.