Overview of economic cycles and their phases-

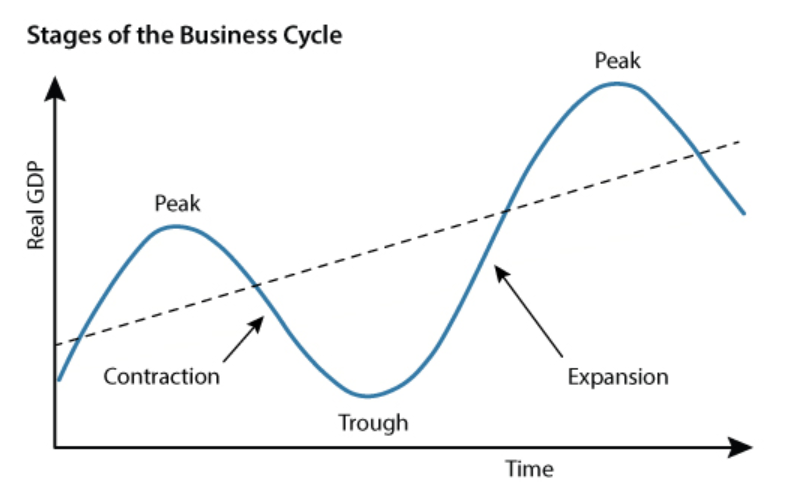

Economic cycles is a natural fluctuation of economic activity during a period of time that is measured from the beginning of one recession to the beginning of the next. Economic cycles goes through various phases: expansion, peak, contraction, and trough. Many factors like gross domestic product, consumer spending, employment and interest rates are used to indicate the current stage of the cycle.

Source: Federal Reserve Bank of St. Louis

Expansion:

- Consumer demand for goods increases, with businesses expanding production to meet such demand.

- Lower interest rates allow easy access to borrow money, thus corporations invest heavily on infrastructure and operations that allow them to meet the growing demand from consumers.

- As a result, firms tend to see growth in their profits as well as share prices. Overall, the gross domestic product (GDP) of a country sees a rise, indicating an economic boom.

Peak:

- GDP reaches its peak through high consumer spending and overall growth of the economy.

- Firms experience higher costs in production to meet the growing demand, which are shifted on to the consumer in the form of higher prices.

- Such higher prices cap or decrease a firm’s profits, creating inflationary pressures.

- The Federal Reserve hikes interest rates to curb inflationary pressures, and overall decrease high spending.

Recession:

- Economic output declines due to a lack of consumer spending and overall demand.

- A lack of demand threatens a company’s profits, making it more likely for a surge in unemployment.

- The Federal Reserve tends to decrease interest rates during a recessionary period with the intent of stifling consumer spending and business investment.

Recovery:

- A decrease in interest rates prove to be beneficial as consumer spending and businesses start gaining momentum, with the economy seeing growth.

- An increased demand incentives companies to start increasing production that decreases unemployment and increases profits, and stock prices

- Overall, a new economic cycle starts with GDP increasing, indicating a growing economy.

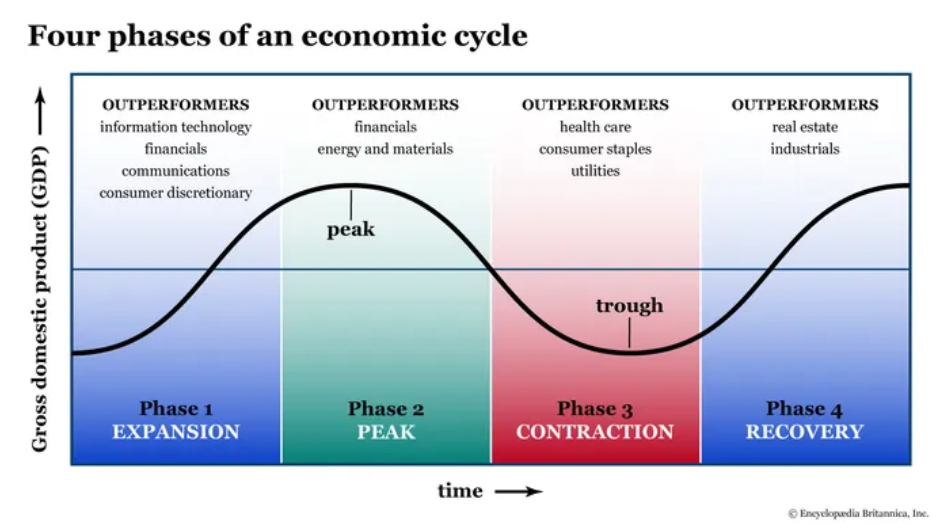

How different sectors perform in various phases-

Expansion:

The expansion stage is a phase where there is a surge in the economy that is attributed to factors like consumer spending, increased business expansion and low interest rates. Thus, sectors that thrive during such growth are the financial, real estate, consumer discretionary, information technology and communications sector. The former three outperform the most in an expansionary period due to lower interest rates that promote higher borrowing.

Peak:

The peak stage of the economic cycle sees maximum economic growth as a result of demand surpassing supply, pushing inflation higher that prompts an increase in interest rates from the Federal Reserve. For this reason, the financial sector, specifically banks, outperforms during this phase. Additionally, the energy, materials, and the information technology sector thrives during this phase as such growth gives companies confidence in the economy, allowing for long-term investments.

Contraction:

The contraction stage is faced with decreased economic growth due to a lack of spending and investments, thus it causes a recession. Consequently, the information technology and consumer discretionary sectors suffer the most during this phase, shrinking profits. On the contrary, sectors related to basic needs like healthcare, consumer staples, and utilities tend to perform well during a recessionary period due to their defensive nature. In like manner, investors tend to invest heavily in bonds and reel money in with the fear of a stock market crash.

Recovery:

The recovery phase starts to see growth in the economy after a recession as a result of economic policies like lower interest rates, which promotes higher spending from both the consumer and the business. For this reason, sectors like industrial and real estate perform well during this phase of growth.

Strategies for investing during different economic cycles

Each phase of the economic cycle affects the financial markets in a unique way, opening up different avenues to invest. Hence, adapting to the markets and investing strategically can boost gains while reducing risk.

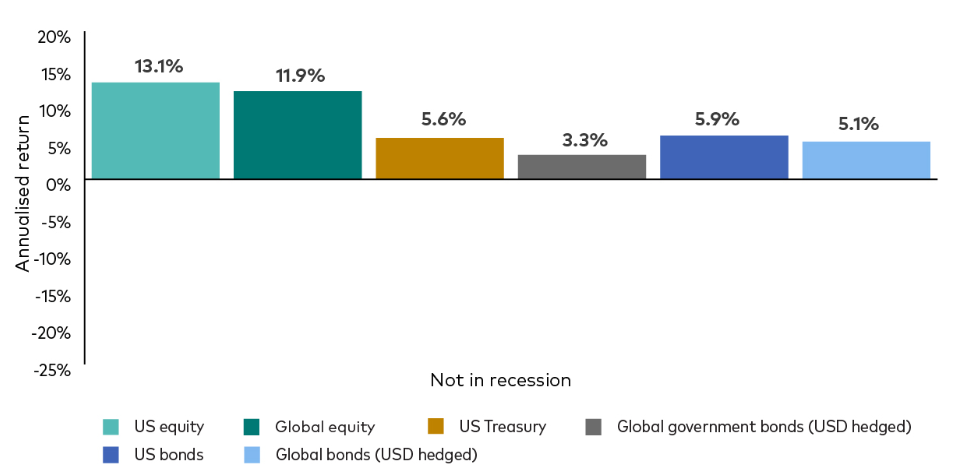

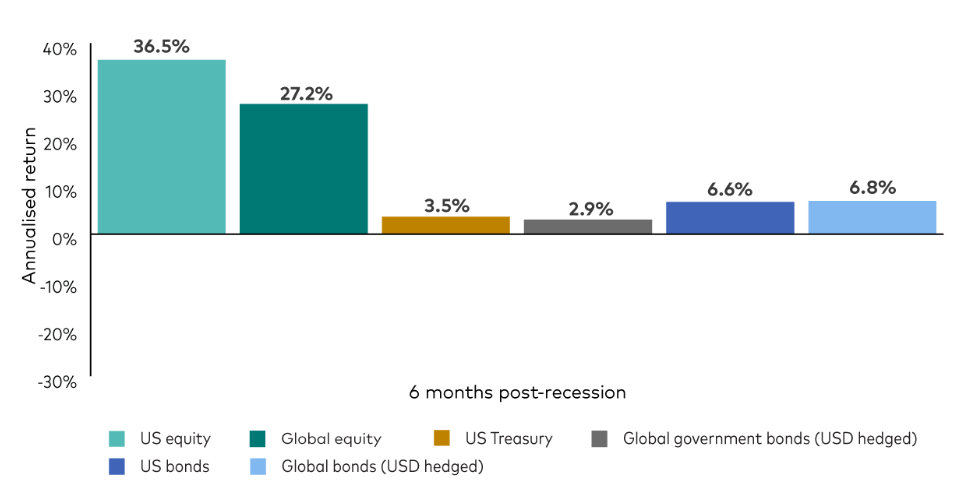

Source: Vanguard

During a period of continuous growth, specifically in the phases of expansion and peak, the stock market tends to outperform. Historical data from the start of 1988 to the end of 2022 prove that the stock market during non-recessionary periods brings an annual return of 12%. And looking at data over 70 years shows that the technology sector returns 21%, the financial sector returns 19%, and the real estate sector returns 18%. For this reason, an investment strategy focused on these sectors during a period of growth will result in a boost in gains while minimizing risks.

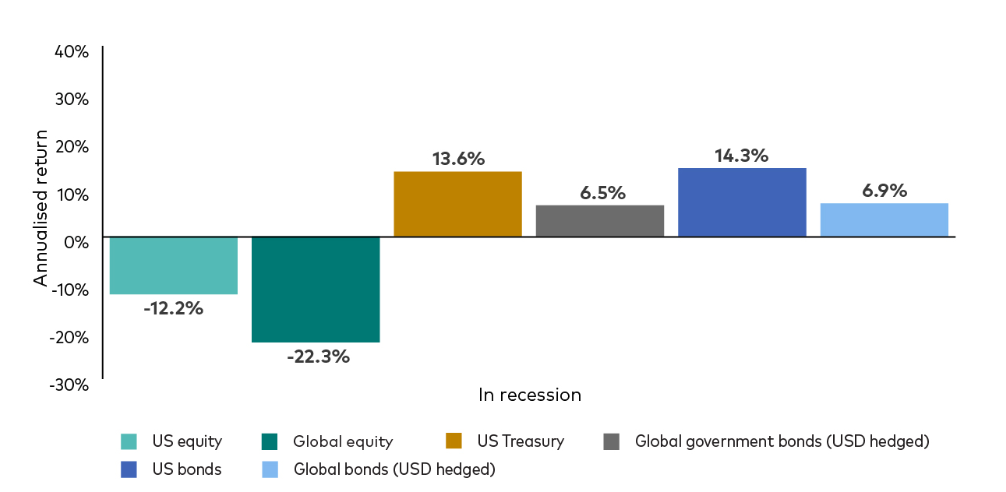

Source: Vanguard

On the contrary, during a period of downturn, specifically during the contraction and trough phase, strategic asset allocation is critical. During such periods, stocks tend to perform poorly, and historically have an annual return of -12%, while fixed income assets—specially bonds—outperform by bringing an annual return of approximately 14%. This outperformance can be attributed to its safe and high-quality nature.

Specifically, during 2008, a period of economic downturn, the average return for US Treasury Bonds was 20.10% With this in mind, an asset allocation from stocks to bonds during a recessionary period has been profitable in the past.

Finally, during the recovery phase, investing in stocks has generated strong returns in the past.. This is supported by historical data that shows that post-recession stocks witness a surge in annual return by approximately 37%. This upward trend is a consequence of increased investor confidence and economic policies, making it optimal to invest.

Subtle mention: Explain how Alphanso’s AI-driven analysis of economic cycles can provide actionable insights for investment decisions.

Through Alphanso’s AI, investment decisions can become easier. This can be attributed to Alphanso’s AI-driven analysis of more than 10,000 financial metrics including economic cycles, market conditions and earnings, which indicate where we are in the cycle and which sectors and stocks are likely to outperform. As an investor, integrating Alphanso’s AI into your investment strategies can enhance your portfolio’s ability to thrive during favorable market conditions, endure through challenging periods, and achieve long-term wealth growth.

Created by: K. Swaroop Hebber, Financial Analyst

Linkedin