This is the second part of our three-part series on navigating the high-yield credit market in 2024 and beyond. In this series, we’ll dive deep into the risks, strategies, and opportunities that investors face in this dynamic and often volatile market.

Part 1: “High-Yield Credit in Uncertain Times: Risks and Strategies for 2024 and Beyond” – We’ll explore the current state of the high-yield market, the factors driving uncertainty, and the key strategies investors can employ to mitigate risks and maximize returns.

Part 2: “US Junk Bond Market: Treading Carefully Despite Maturing Debt” – In this installment, we’ll focus on the US junk bond market, examining the impact of maturing debt on default rates and investor sentiment. We’ll also discuss the importance of careful credit selection in this environment.

Part 3: “Taming the High-Yield Beast: A Guide for Bond Investors in a Slowing Economy” – Our final piece will provide a comprehensive guide for bond investors navigating the high-yield market in a slowing economy. We’ll cover the role of central bank policies, the potential for spread tightening, and the key factors to consider when building a resilient high-yield portfolio.

Part 2 starts below…

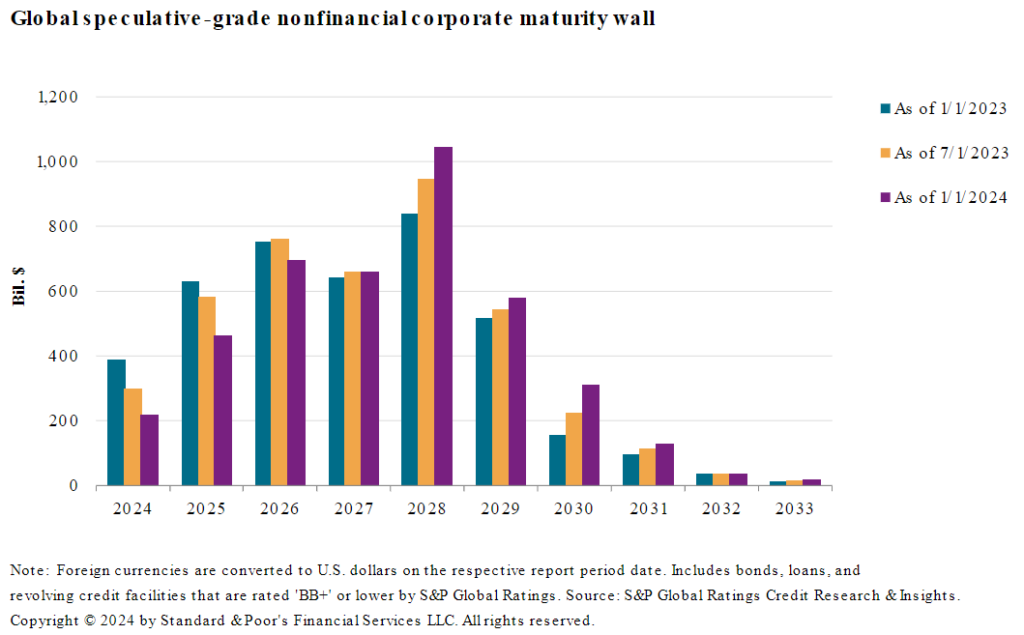

The US high-yield bond market, often nicknamed the “junk bond” market, faces a looming hurdle: refinancing nearly $882 billion in debt by 2026 (part of a global $1.5 trillion, according to S&P Global). This could pose significant challenges for some companies.

However, there are early signs of resilience. Favorable economic conditions, attractive yields for investors, and subdued inflation are providing a buffer. Default rates on these high-risk bonds have remained remarkably low, hovering around 4%, with only a modest increase projected to 4.75% by year-end.

The return of even riskier “CCC-rated” borrowers to the market, despite concerns about rising interest rates, indicates confidence in the underlying economic strength. For now, continued economic growth seems to outweigh borrowing costs as the main driver for this market, even with traditional recessionary indicators flashing yellow.

In short, the US junk bond market is navigating a tricky refinancing landscape, but early signs suggest it may be weathering the storm thanks to a supportive economic environment.

Economic Tug-of-War: Slowdown vs. Inflation

While the worst of inflation seems to have passed, investors now face a new challenge – a potential economic slowdown. Earlier optimism about rate cuts faded by November as investors flooded back into the market, driving bond yields down and prices up.

The International Monetary Fund predicts a sluggish global economic growth rate of 3.5% for 2024, a significant drop from last year’s 5.9%. This slowdown can be attributed to factors like the ongoing war in Ukraine and potential supply chain disruptions.

However, central banks are still wary of inflation. Although showing signs of easing, the US Consumer Price Index remains above the Federal Reserve’s target of 2%. As of March 2024, it sits at around 3.2%, leaving policymakers in a balancing act between managing growth and controlling inflation.

Bond Market Outlook: Higher Yields Here to Stay (For Now)

Hold onto your hats, bond investors – higher yields are expected to stick around for a while. Despite a global slowdown in central bank rate hikes, elevated levels are likely to persist through most of 2024 before any major dips.

The US is a prime example. Although inflation has shown signs of cooling, interest rates are likely to stay high until later in 2024. The Federal Reserve is expected to maintain its wait-and-see approach until inflation gets closer to its 2% target. Once this happens, we might see them ease on the brakes, potentially amidst a slowdown in US economic growth.

Here’s the good news for bondholders: even with the recent bump in Treasury prices, yields remain enticing. Take the US 10-year Treasury, currently yielding a healthy 3.9%. This environment presents a sweet spot for bond investors, as a significant chunk of long-term returns comes directly from these yields.

Looking ahead, a decline in yields is anticipated later in 2024. This means bond prices are likely to rise. To maximize your exposure to these potential gains as yields fall, consider extending the duration of your bond holdings.

Late Cycle Blues: Not a One-Size-Fits-All Picture

The spectre of rising interest rates hangs heavy over the credit cycle. We’re already seeing the brakes being applied across various sectors as rate hikes take effect. While companies are still beating earnings expectations, their performance has noticeably cooled compared to past cycles.

Some businesses are reporting a dip in consumer spending, likely due to households burning through a portion of their pandemic savings. At the same time, corporate debt levels (leverage) are climbing, and the ability to service that debt (earnings to interest payments ratio) is weakening.

However, a widespread wave of defaults and credit downgrades isn’t on the radar. Many companies entered this phase with strong underlying fundamentals, providing a buffer. Additionally, the anticipated rate cuts later in the year should offer some relief to corporations facing refinancing challenges.

In essence, the late-cycle environment presents a mixed bag. While there are signs of stress, the situation isn’t dire for all companies.

High-Yield Bonds in a Storm: Allure vs. Risk

The allure of high-yield bonds remains, but economic headwinds demand a cautious approach. The Slower Global Growth and Persistent Inflation can lead to:

- Rising Default Risk: A slowing economy can make it harder for companies to repay their high-yield debt, increasing the chance of defaults and potential investor losses.

- Widening Credit Spreads: As investors demand a higher premium for the increased risk, the gap between high-yield bond yields and safer government bond yields may widen.

- Lower Market Liquidity: Trading activity in high-yield bonds might decrease, making it more difficult to buy or sell them when needed.

You can read part 1 here and part 3 here.

This is not financial advice. The views and opinions expressed are personal and do not necessarily reflect the views or positions of Alphanso or any entities they present.